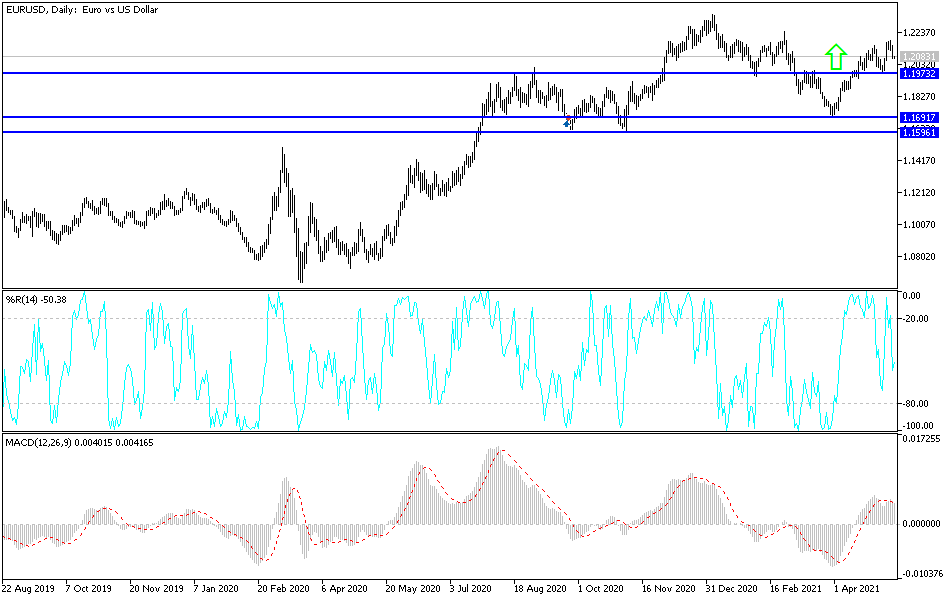

The euro broke down significantly during the trading session on Wednesday as the 1.22 level has continued to show a lot of resistance. As CPI numbers in the United States came out much hotter than anticipated, it has worked against the value of other currencies as the greenback rallied quite drastically. That being said, we are still very much in an uptrend when it comes to the euro, and there are some things that people will be paying close attention to over the next couple of days.

The size of the candlestick is fairly negative, and it does suggest that we may have a little bit more in the way of downward pressure coming, as when we close towards the bottom of a large candlestick it typically means there will be a little bit of follow-through. That lines up quite nicely with the charts, as the 1.20 level has been important more than once and is also backed up by the 50-day EMA. The 50-day EMA has been important for a couple of weeks now and is also starting to drift higher. This suggests that we should continue to see buyers over the longer term.

One thing to keep in mind when it comes to the value of the US dollar is that this sudden shock with the CPI numbers will be short-lived, because even though the inflation numbers in the United States are spiking, the reality is that the Federal Reserve is nowhere near tightening monetary policy, and has stated more than once that it is going to let inflation run hot. With that in mind, I do not think that the US dollar will strengthen for the longer term, and I believe it is only a matter of time before traders start to look at the situation as one that is oversold, as we will be trying to build up enough momentum to finally break above the 1.22 handle. However, if we were to break down below the 1.20 handle, then the market is likely to go towards the 200-day EMA. In the short term, it is simply a matter of waiting to see signs of stability before risking anybody in this market. I would not be surprised at all to see this entire move turn right back around.