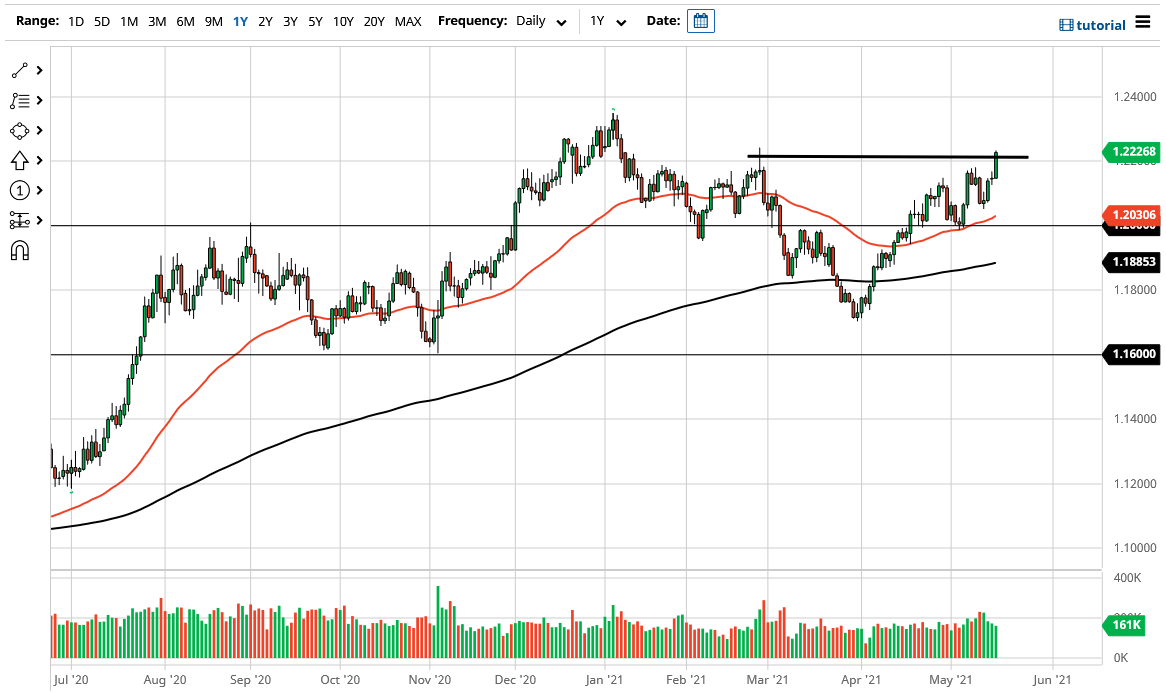

The euro had a very strong session on Tuesday to break above the 1.22 handle, and looks very likely to go looking towards the 1.23 level given enough time. When you look at the chart, it is obvious that there has been a massive amount of bullish pressure during the day, and we have continued to see the short-term dips be bought. The fact that we are closing at the very top of the range is also a very bullish sign as well.

When you look at the US dollar in general, it has been selling off, so I think that we will continue to see upward pressure in this pair. That being said, the euro is a currency that tends to be very choppy and noisy, so I think it is difficult to get overly excited about this. However, as we break out in this general vicinity, I think that what we probably will do as traders is look for opportunities to short the greenback against other currencies. However, if you are hell-bent on trading the euro, then the only direction that you should be looking at is to the upside. You may need to find short-term pullbacks in order to play a short-term trade, but from a longer-term perspective, it is not until we break above the 1.23 level that we are free to go higher.

If we do break above the 1.23 handle, then it is likely that the euro will go looking towards the 1.25 handle. That is one of the most common levels for analysts lately, so I think it could be a bit of a “self-fulfilling prophecy.” In general, this is a market that I think will continue to be one that you have to play from short-term charts, though, because you will likely make more money shorting the greenback against other currencies that move much more. To the downside, I think there is plenty of support underneath near the 1.21 handle, and then the 50-day EMA that is now starting to curl to the upside. In general, I believe that shorting this market is all but impossible, as the trend has so firmly ensconced itself, and we continue to see the greenback suffer at the hands of multiple assets.