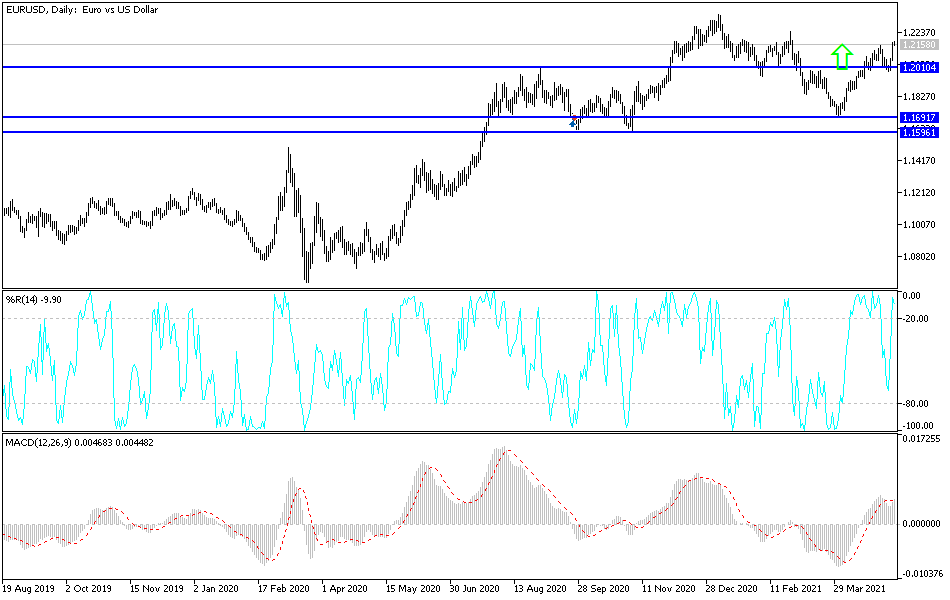

The euro rallied significantly during the trading session on Friday, breaking above the 1.2150 handle. At this point, the market looks as if it is going to close at the very highs of the session, which is a good sign that we are probably going to see a bit of follow-through given enough time. I think the next target is the 1.22 handle, which could offer a little bit of selling pressure; but given enough time, we will probably go looking towards the 1.24 handle.

Underneath, the 1.20 level offers support, and I think if we do pull back in the short term, it is very likely that we will find buyers underneath. The size of the last couple of candlesticks tells you the story in general, as the US dollar continues to find itself on the back foot. The 50-day EMA is currently sitting just below the 1.20 handle, and it makes sense that we would see a lot of follow-through every time we dip. The market does continue to focus on the yields in America, which fell as people bought bonds.

Furthermore, we also have the European Union looking to reopen, and the fact that the lockdowns may be slowing down eventually suggests that the Europeans may see a little bit more growth than previously thought. Furthermore, we also have downward pressure in the greenback against other currencies as well, so that does add more credence, as currency markets tend to move in one direction when it comes to the dollar.

I do believe that eventually we will see buyers jump in on the short-term dips, and if you pay attention to short-term charts, you can see signs of life on any type of significant pullback. On the other hand, if we break above the 1.22 handle, then I think you just simply either add to an existing position or open up a new one. I do think that the “fix is in”, meaning that the US dollar continues to fall as the market is already starting to reprice the idea of the Federal Reserve tinkering with the economy yet again.