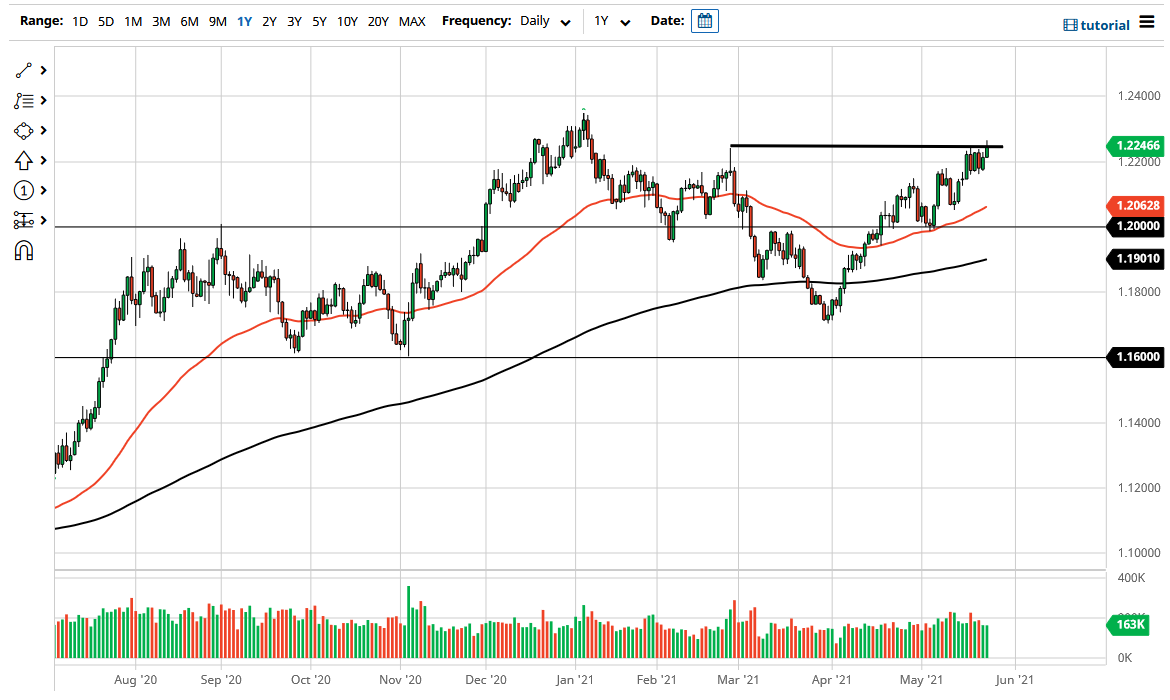

The euro rallied a bit during the trading session on Tuesday to break above the short-term resistance barrier. If the market can continue the upward momentum, then it is likely that we could go looking towards the 1.23 handle. The 1.23 level was important in the past, so I think it does act as a bit of a magnet for price.

One of the main reasons we took off during the day on Tuesday was that the German Ifo figures came out much stronger than anticipated for the month, which suggests that perhaps there is a little bit more in the way of confidence when it comes to the German economy by small businesses overall. That suggests, as it is a leading indicator, that we could see Europe continue to outperform a bit as the economy wakes up from the COVID lockdowns.

Keep in mind that this pair does face a significant amount of resistance above, so I do not necessarily think that we will simply take off to the upside. It is worth noting that we did give back quite a bit of the move after the breakout during the trading session, so it is possible that we need to work a little harder to finally take off. Underneath, I believe that the 1.20 level is going to offer significant support, and function as a “floor in the market” currently. We also have the 50-day EMA above there that should be important, so keep that in mind as well.

If we can finally break above the 1.23 handle, then it is very possible that we wlll go looking towards the 1.24 level, and then by extension, the 1.25 level based upon longer-term charts. The 1.25 level will attract a lot of attention, and it is worth noting that a lot of the large analyst community believes in the story of reaching towards the 1.25 handle. I think we can as well, but it could be a story for later this summer, as this pair does tend to move somewhat slowly.

Regardless, I think that we are going to stay bullish for a while, so I look at dips as potential buying opportunities. By taking advantage of value, you can make this pair work a little bit more in your favor, because it does tend to be very choppy, and the volatility leaves a little to be desired at times.