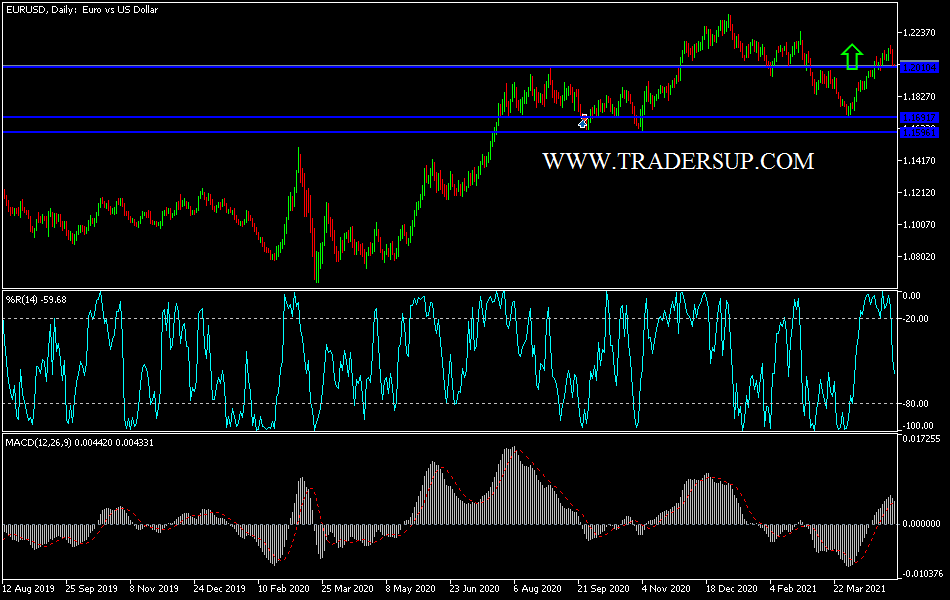

The euro broke down significantly during the trading session on Monday to reach towards the previous downtrend line that we have broken. The 1.20 level underneath should offer support as well, as it is a large, round, psychologically significant figure. With this being the case, the market is likely to see value hunters in that area, and the 50-day EMA is starting to reach towards that level and curl higher. The US dollar continues to get hit in general, so it would make sense that sooner or later the euro will continue to ride higher. That being said, the fact that we ended up forming the candlestick that we have - and we are closing towards the bottom of it - tells me that there will probably be a little bit of follow-through.

The market had gotten ahead of itself, so I think seen a little bit of a pullback probably is a good thing and something that you would anticipate as we had gotten ahead of ourselves. If we turn around and break above the highs from the Thursday session, that signifies that we are probably going to go attacking the 1.22 handle, perhaps even the 1.23 level given enough time.

Notice that there is a huge “V pattern” that we have recently formed, and that typically means that we are going to see a little bit of continuation. However, if we were to break down below the black 200-day EMA, then I think it is likely that we start to fall apart again, but that is probably going to be based upon US dollar strength more than anything else. As far as the euro is concerned, the European Union is starting to see bond yields rise slightly, and it is possible that the German yields may even go positive in the next few weeks, which would drive the currency higher.

At this point, I think this is a market that is simply trying to work off some of the froth as traders are trying to take home profits at the end of the month and week. Ultimately, this is a market that will eventually offer a supportive candle that I will be willing to jump on, but I also recognize that it could be noisy.