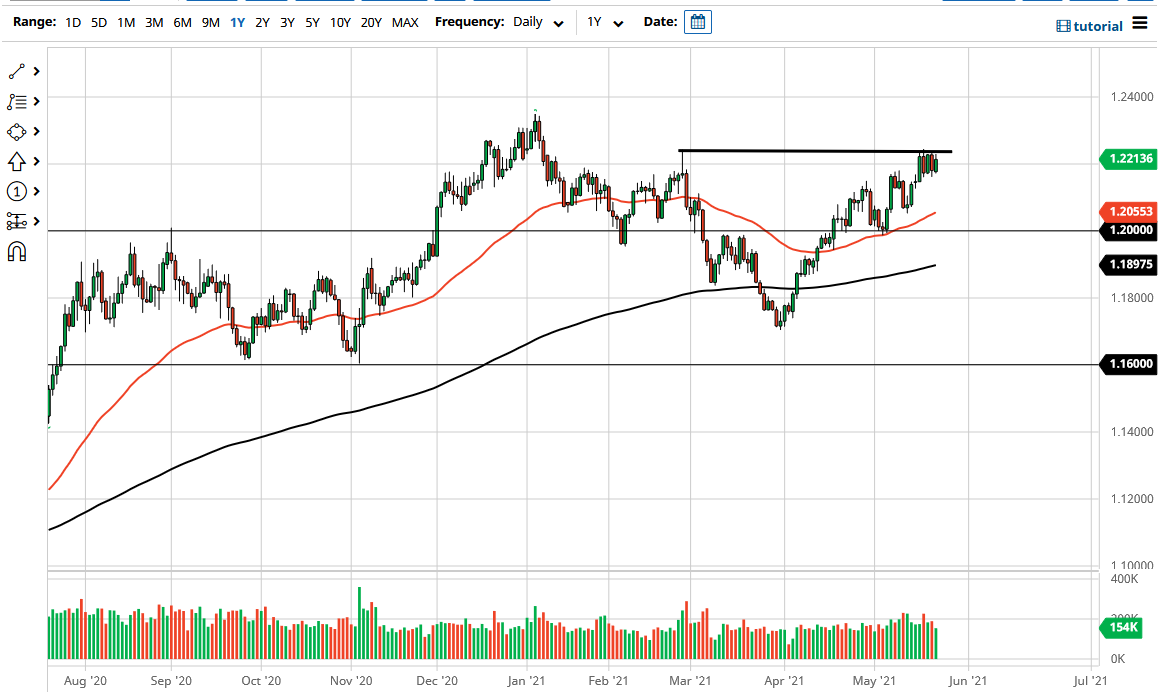

The euro rallied a bit during the trading session on Monday as we continue to press the resistance barrier from last week. It certainly looks as if the market is trying to do everything it can to break out, and if we do break the highs of the last couple of days, the euro will probably go looking towards the 1.23 handle. That is an area that I think will end up being somewhat resistive, as it had recently been a bit of a top in the market. If we break above that level, then it is likely that the euro will go looking towards the 1.25 handle over the longer term.

To the downside, we could very easily find ourselves wiping out the gains from the session on Monday, to reach down towards the lows of last Friday, which is essentially the tight range that we are stuck in. This should not be a huge surprise though, because the euro is one of the choppiest and ugliest markets to trade most of the time. This is because there is so much liquidity that it does not move like other currency pairs. It just chops back and forth in general. That being said, the market is likely to continue to see more upward pressure, but I am not looking for some type of major move in the short term.

If we do break above the 1.23 level, then we could possibly see a little bit of an increase in momentum, which is exactly what this pair needs to be a bit more interesting. That being said, this is a market that I think eventually will attract value hunters on each dip, all the way down to at least the 1.20 handle, which is a large, round, psychologically significant floor more than anything else in the market. I do not like shorting this market, mainly because the US dollar itself is on the back foot, and the euro is typically thought of as “the anti-dollar”, so it certainly makes sense that we would see this market pick up momentum. With the massive liquidity measures being taken by the Federal Reserve, we may see more of this sooner rather than later.