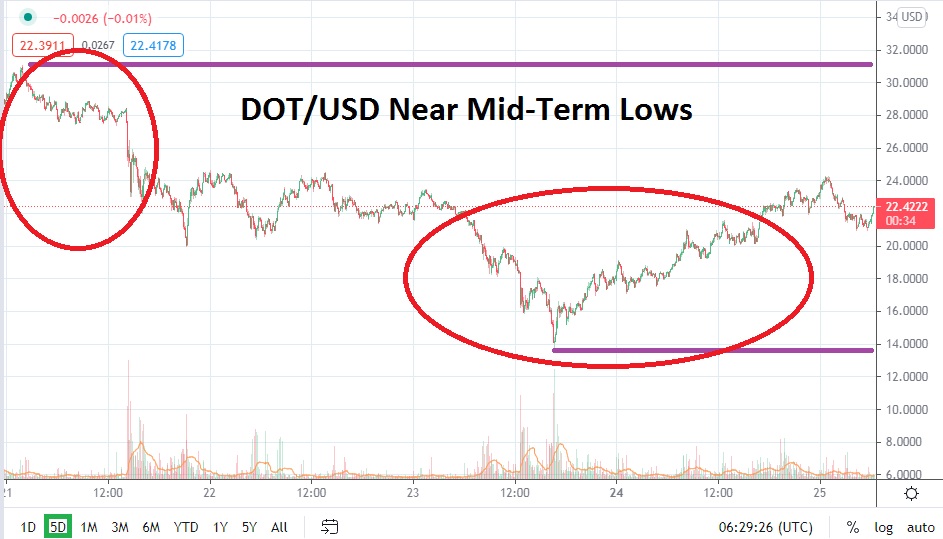

After achieving a record value of nearly 50.0000 on the 15th of May, DOT/USD has lost more than half of its value. As of this writing, DOT/USD is hovering near the 22.5000 juncture with important mid-term support levels clearly in sight. The broad cryptocurrency market has suffered from strong bearish momentum. Polkadot is not alone as it has seen its value plunge, and many speculators may remain bullish with their long-term perspectives. However, short-term perceptions and long-term outlooks can often have two different viewpoints.

Technical traders will need to look at six-month charts to gather a deeper perspective regarding the current value of DOT/USD. The current price vicinity of Polkadot has the cryptocurrency trading near values last seen in a large transactional mode on the 10th of February. Support around the 21.5000 to 21.0000 junctures could prove to be a major inflection point if bearish sentiment remains prevalent in the broad cryptocurrency market.

During the weekend, DOT/USD did plunge to a value slightly below the 15.0000 mark, but this was a momentary plunge. DOT/USD recovered and traded near a high slightly over 24.0000 in early trading today, but has since then reversed lower. The move to the lower depths of Polkadot value displayed on the 23rd of May touched levels seen in the last week of January. The question is if this bearish spike is a signal for things to come.

DOT/USD must overcome its current short-term resistance levels near the 24.5000 level and sustain higher values to wipe away some of the bearish sentiment which is shadowing. If DOT/USD is not able to trade above this level in the short term and continues to flounder near the 22.5000 price, it is possible that speculators will suspect that more bearish activity can be produced. Cautious sellers with downside perspectives may want to wait for slight reversals higher within Polkadot to initiate their short positions and aim for support as a take-profit plan.

DOT/USD is near important mid-term resistance and, if broad sentiment in cryptocurrencies remains nervous, this may spark more technical selling for the digital currency. Trading conditions have certainly been fast the past week, and speculators need to anticipate additional hectic price action. Selling DOT/USD and aiming for support levels may be a solid speculative wager short term.

Polkadot Short-Term Outlook:

Current Resistance: 24.5000

Current Support: 21.3700

High Target: 27.4000

Low Target: 18.3000