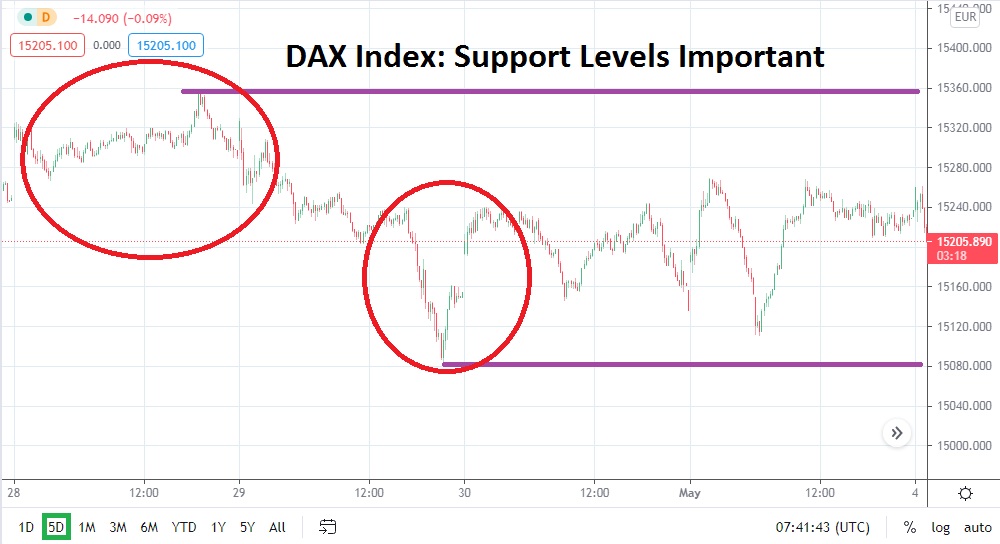

The DAX Index has run into headwinds the past week of trading as resistance levels have pushed the German equity index slightly lower. Speculators who have been pursuing bullish momentum may be reconsidering their perspectives, particularly if their nervousness is growing and they assume an element of profit-taking will foster. However, the DAX Index actually is maintaining its higher longer-term range rather well when looking at technical charts, and traders need to remember that timing the market remains an always difficult task.

After reaching all-time highs in the middle of April and testing the 15500.00 juncture briefly, the DAX Index has largely traversed between 15100.00 and 15300.00 with the occasional value outlier. Global risk sentiment in equity indices remains speculative and some might say optimistic. The major indices in the US were mostly positive yesterday and, this morning, early indications are signaling a cautious opening on Wall Street.

The DAX Index has enjoyed the fruits of a long-term bullish run and now may not be the time to jump off of the trend. Instead, speculators should consider monitoring support levels carefully and consider using them as places to activate buying positions which use close stop-loss orders to protect their accounts.

Support near the 15147.00 to 15100.00 junctures may prove to be solid values to try and participate in the DAX Index as a buyer. A low of 15080.00 was tested on the 29th of April and has proven to be rather adequate as lower support, having performed the same task on the 21st of April. Conservative traders may want to wait for the DAX Index to come within proximity of this lower value before going long, but they will need patience and might miss an opportunity to buy into the marketplace.

Yes, the DAX Index has been difficult the past couple of weeks and delivered rather choppy results as short-term resistance have created a fight. However, the long-term trend with equity indices continues to demonstrate an ability to suddenly develop swift upward trajectories. Therefore, using support levels as a place to enter the DAX Index as a buyer remains a good conservative speculative decision.

DAX Index Short-Term Outlook:

Current Resistance: 15270.000

Current Support: 15147.000

High Target: 15365.000

Low Target: 15085.000