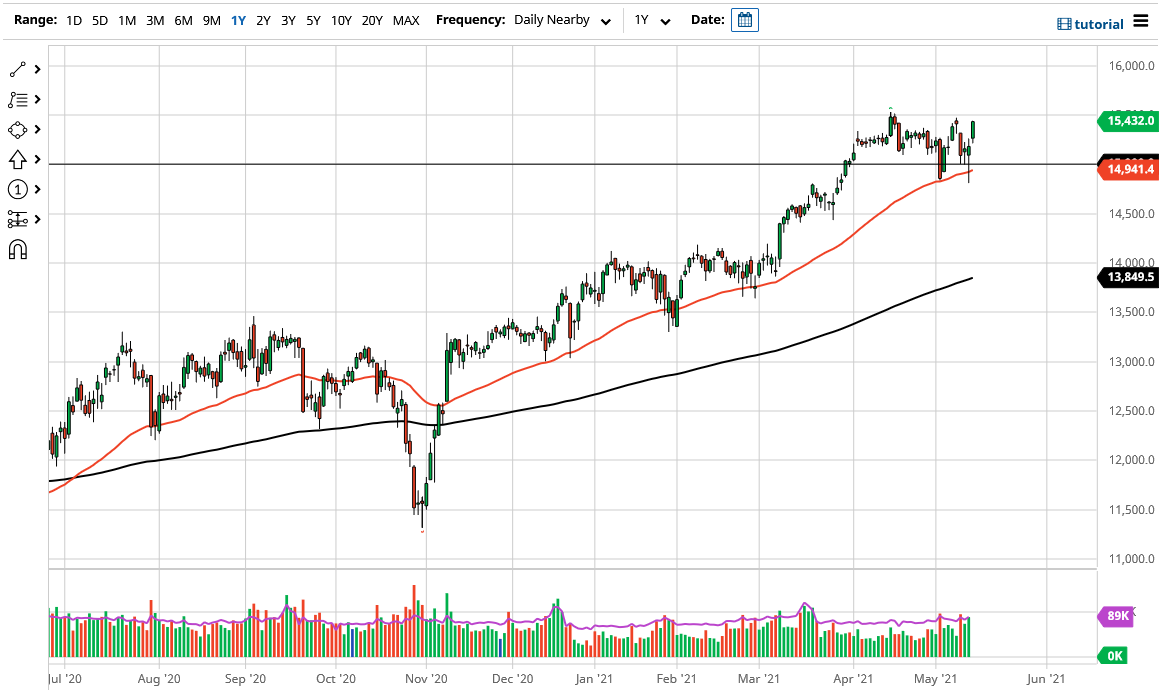

The German index rallied during the trading session on Friday, after a gapped higher to open the day. Furthermore, the market closed at the very top of the range for the day, so that does suggest that we have plenty of buyers in this market. Beyond that, the volume was fairly strong, so all things being equal it looks like we are going to continue to go higher. Ultimately, if we do break above the 15,500 level, then the market is likely to go looking towards the 16,000 level based upon the measured move of the overall consolidation that we are currently trading in.

When you look at the candlestick from the Thursday session, that should tell you where the bottom of this move is. If we break down below the bottom of the candlestick from the trading session on Thursday, then it opens up a move down to the 14,500 level. That is an area where we have also seen a significant amount of support, so I would not be surprised at all to see buyers come back in there as well. After that, then we could be looking at a move down to the 14,000 level, where we see a significant amount of support coming in at the 200 day EMA just below there. In other words, there are plenty of areas where there should be value in the stock index. Nonetheless, when I look at this market, I believe that there are many reasons to think that we are going to continue to go higher.

The 16,000 level is my target for this market sometime this summer, and I do think that we should reach their rather quickly. Breaking above there then opens up another 500 point move to the 16,500 level. All things being equal, the DAX should continue to see buyers jump in due to the idea that the global economy is starting to reopen and of course Germany is a major exporter of industrial goods. Beyond that, the German economic numbers have been relatively good, so I do think that money will continue to flow in what is an obvious uptrend to begin with. The recent consolidation has been simply working off the “froth in the market” as we have seen in multiple other stock indices around the world.