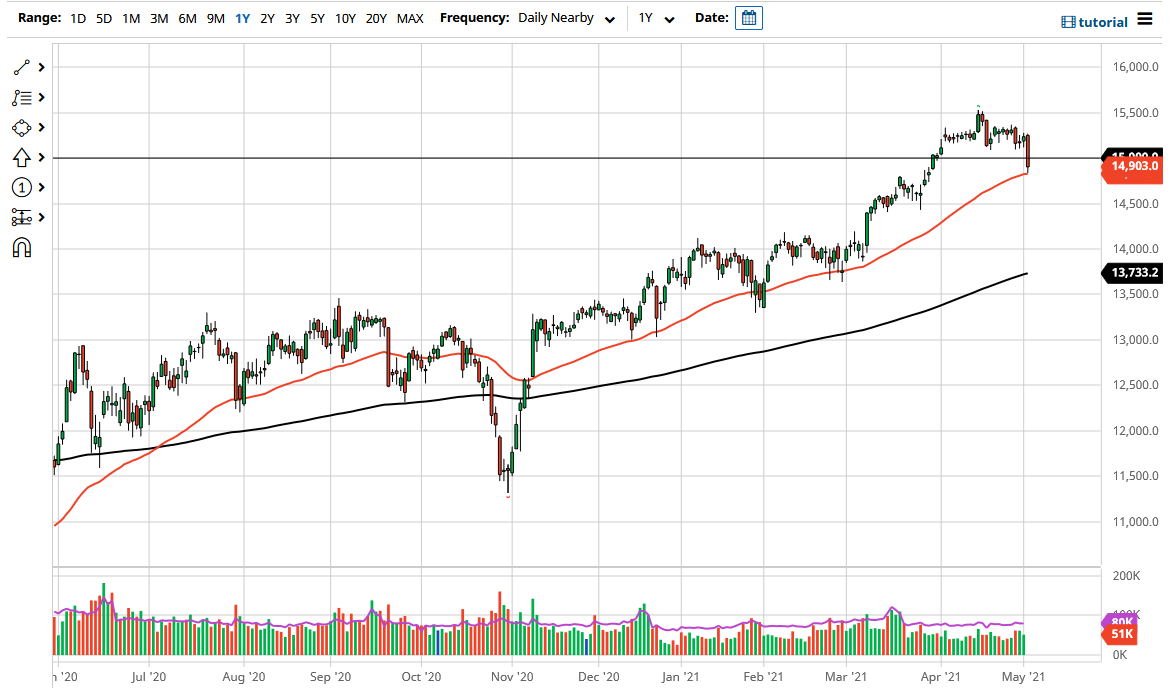

The DAX Index fell rather hard during the trading session on Tuesday to break down below the crucial 15,000 level. This is a bit of a surprise, but it should be noted that the 50-day EMA seems to be offering a bit of support at the end of the session. After you see a candlestick like this, quite often you will see a bit of follow-through; but what is important to see is how the Wednesday candlestick it is going to close. This is because a lot of times we get a “false breakdown”, and then a turnaround late in the day. Because of this, I will be watching the close very closely on the daily chart.

If we close above the 50-day EMA, then I think this is a simple pullback that people will be taking advantage of, as this is a market that is obviously very bullish. However, if we close below the 50-day EMA, it shows that we have seen quite a bit of negative pressure continuing to enter the marketplace, and then it could represent an even more significant pullback. If you been watching my videos the last several sessions, you know that the 14,500 level could also be supportive, so that would be the next area I would be looking at for a potential buying opportunity. That being said, I would need to see some type of bullish candlestick, or at least supportive candlestick, on the daily chart in order to get long.

If we break down below the 14,500 level, then it is likely that we go looking towards the 200-day EMA below, which at this point is racing towards the crucial 14,000 handle. Breaking that is the definition of a downtrend, so at that point the market would probably fall quite drastically.

Nonetheless, the market is much more likely to go higher than lower based upon the overall trend, despite the fact that this has been a very negative candlestick. With that being said, I think if you are patient enough, you should get an opportunity to get long again, and even if we do not get the right candlestick formation, obviously if we were to wipe out this candlestick and go above it, that in and of itself would be a bullish sign as well.