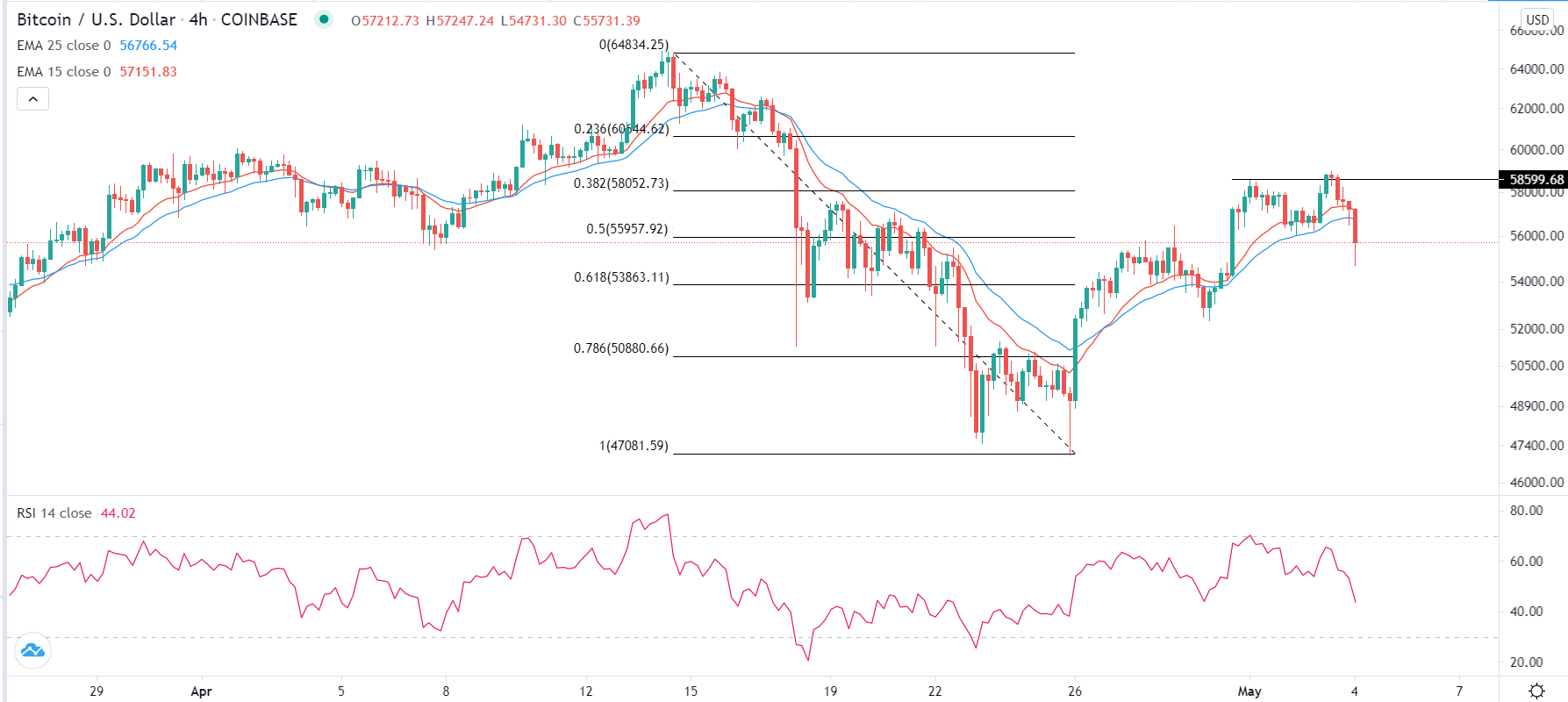

Bitcoin went back and forth during the trading session on Monday as traders continue to push this market higher. The market has recently bounced from the $50,000 level, so I am currently looking at this as the “floor in the market”, and I think there will be a lot of interest in this market on dips going down to this region. On the other hand, the $60,000 level above is rather important, so I think that if we can break above there then it is very likely that we will go looking towards the all-time highs again.

The 50-day EMA is essentially flat and offering a little bit of dynamic support. That being said, the market is most certainly bullish in general, so I think what we are seeing here is a market trying to stabilize just above the $50,000 level in order for the trend to continue going higher. Being comfortable between the $50,000 level and the $60,000 level is a good sign, and that should continue to be important psychological as well as structural levels. Because of this, I think we may be in a little bit of a consolidation phase, but that is simply the market trying to work off some of the excess froth that we have seen as of late.

The $65,000 level above being broken would be a very bullish sign and could send this market looking towards the $70,000 level, as Bitcoin does tend to move in $5000 increments. Conversely, if we were to break down below the lows of last week, it could send this market looking towards the $45,000 level, possibly even the $40,000 level, where I believe that the 200-day EMA is going to come into the picture as well.

We have been in an uptrend for quite some time, so it makes sense that we would see these pullbacks bring value hunters back into the market. After all, Bitcoin has been very strong over the last several quarters, and I do believe that will continue to be the case. However, if we were to break down below the $40,000 level, then it could change quite a few things, but right now it does not look likely to happen. I think we will simply chop back and forth in the short term with more of an upward bias.