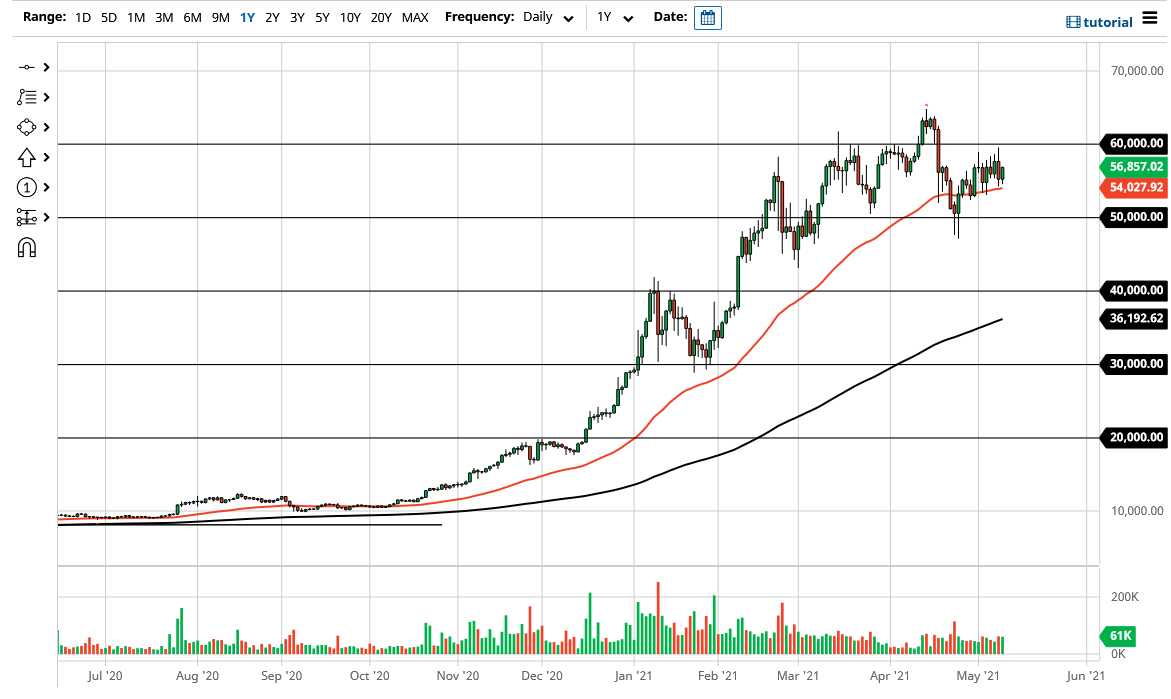

Bitcoin markets fell initially to kick off the Tuesday session, but as we have seen multiple times, buyers have come back in to pick up the market and go sideways in general. After all, the 50 day EMA is a technical indicator that a lot of people pay close attention to and has most certainly been supportive over the last couple of weeks. Essentially, we have been bouncing between the 50 day EMA underneath and the $60,000 level above. This consolidation is probably healthy, due to the fact that we had gone straight up in the air previously.

Even if we were to break down below the 50 day EMA, I think there are plenty of buyers near the $50,000 level that could come into the picture. The $50,000 level is of course a large, round, psychologically significant figure, and an area that a lot of traders had gotten into previously. At this point, if we were to break down below the hammer sits at the $50,000 level, we could have a little bit more of a correction, perhaps down to the 200 day EMA. That all ties together quite nicely, because it also brings into focus the $40,000 level, which makes a nice recovery play as we are most certainly in an uptrend for the longer term.

Institutional money has flown into the Bitcoin market quite drastically, and of course will be looking to take advantage of dips as value. Retail traders are having a little bit of trouble swallowing the idea of buying an entire coin, so that is most certainly something that comes into play and it should also be noted that Ethereum has taken some of the momentum out of this market. Furthermore, you can also make an argument for it being “alt coin season.” We are starting to see Cardano, EOS, and many others take off quite drastically. With that being the case, I think Bitcoin might be a bit quiet, but it most certainly is something that will continue to attract inflows over the longer term. I have no interest in shorting Bitcoin as it has been so strong and every time you have tried it recently you probably lost money. Longer-term, I think that the market will go looking towards the highs that we need some type of catalyst.