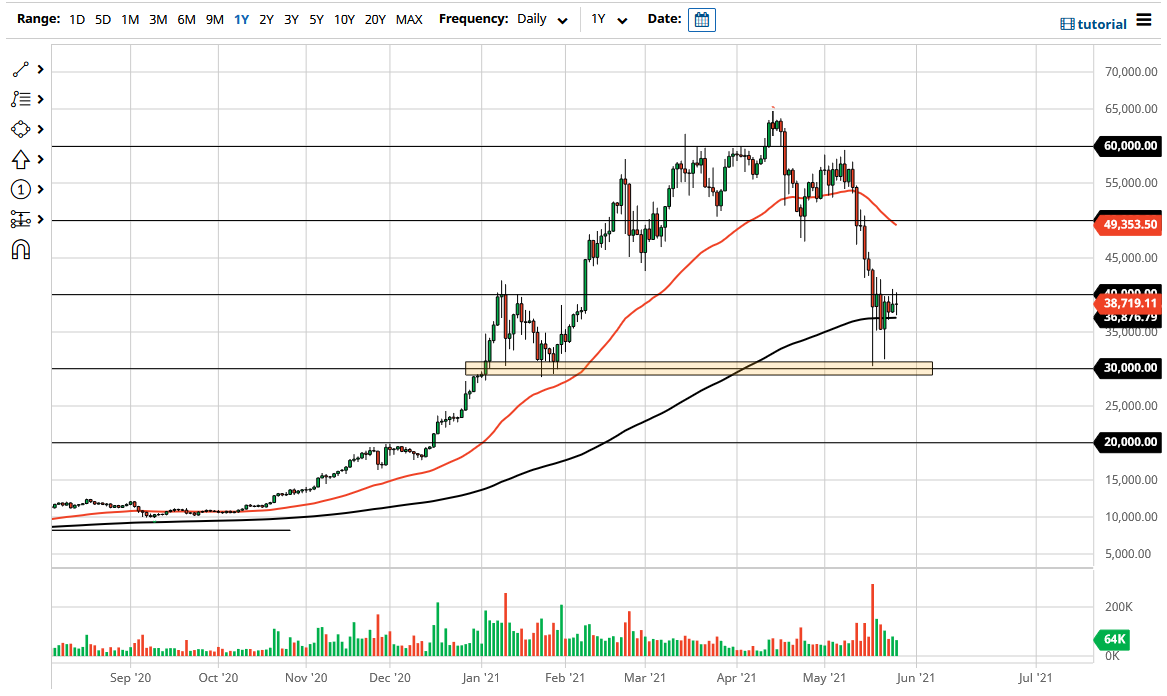

If we can break above the $40,000 level, then the market could go higher, perhaps reaching towards the 50 day EMA. It is worth noting that the last couple of days have been rather quiet for Bitcoin, which of course is a good sign due to the fact that we had seen quite a bit of selling pressure, and now it looks like the market is finally trying to calm down enough to “test the waters.”

Underneath, the $30,000 level of course is rather supportive, and as a result I think we continue to look at that through the prism of massive support. In fact, I think of it as a bit of a “floor in the market”, and therefore if we were to break down below that level, the market could fall apart and then possibly send traders looking towards the $20,000 level. The $20,000 level was important in the past as well, and a move down to that level would wipe out a significant amount of the froth that we had seen build up over the last several months.

Bitcoin has seen a bit of institutional adoption, but the big players are still not in the market. Perhaps they will be interested in getting involved at a lower price, but will we are seeing here is a scenario where the longer we stay in this general vicinity, the better the outlook for the market would be. If we can break above that $40,000 level on a daily close, I think it is likely to be a good sign. Furthermore, we have to pay close attention to the US dollar, because if it continues to sell off that could be positive for Bitcoin as it is priced in that currency, at least in this market.

In general, the market is one that is going to have to take it is time to build up a position and perhaps move forward, so what you need to see is a breakout of this $10,000 range. An impulsive candlestick of course is what we need to see, perhaps one that closes towards the top of the range but then we can put money to work.