Bearish View

- Set a sell-stop at 0.7700 (psychologically important level).

- Add a take-profit at 0.7650 and a stop-loss at 0.7750.

- Timeline: 1-2 days.

Bullish View

- Set a buy-stop at 0.7750 and a take-profit at 0.7850.

- Add a stop-loss at 0.7700.

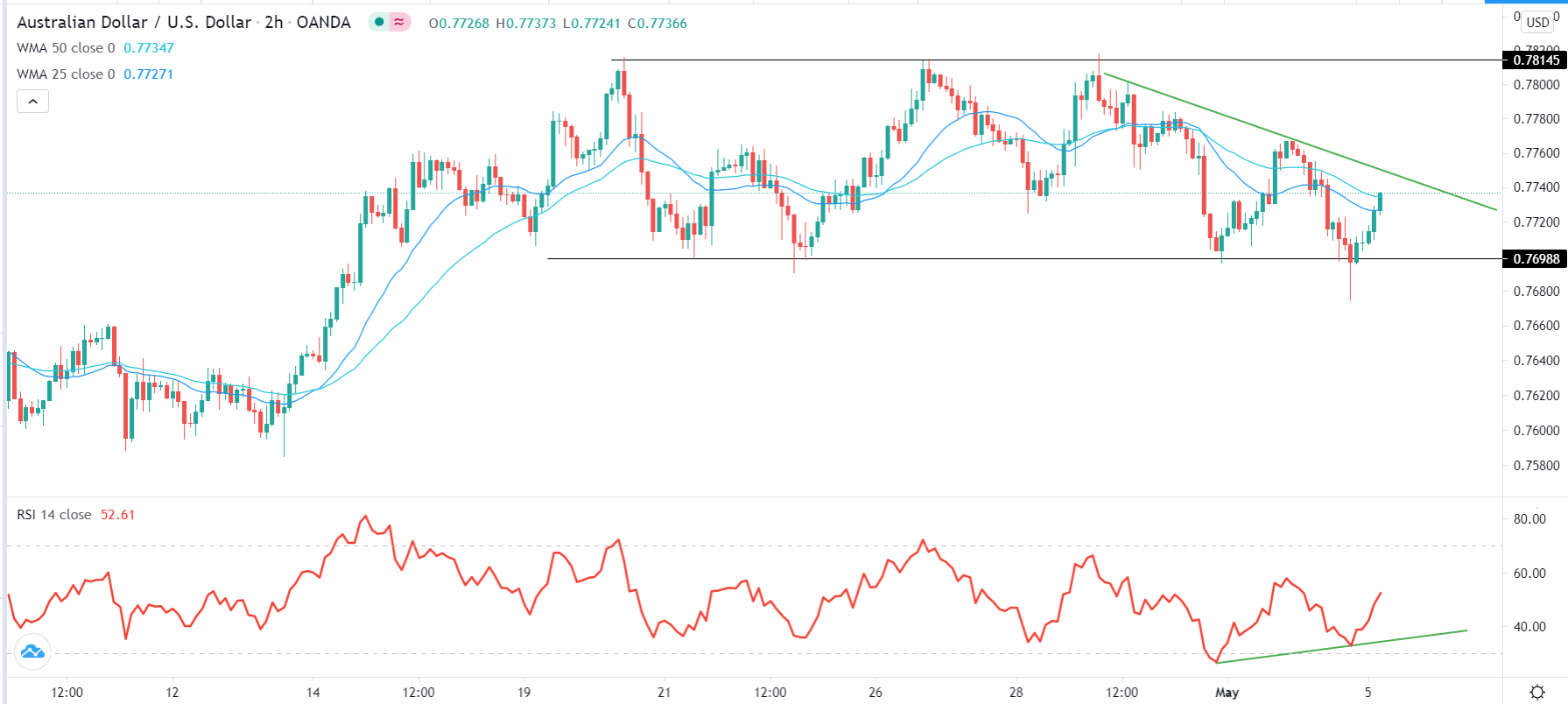

The AUD/USD price bounced back after data showed that the Australian economy was firing on all cylinders. The pair also reacted to the clarification by Janet Yellen on high-interest rates. It is trading at 0.7735, which is higher than yesterday’s low of 0.7675.

Australian Economic Strength

Recent data have shown that the Australian economy was doing incredibly well. On Monday, data by Markit and the Australia Industry Group (AIG) showed that the Manufacturing PMI was hovering near 60. Further data released yesterday showed that the country’s exports and imports remained strong in March.

Today, data by Markit revealed that the important Services PMI rose from 55.5 in March to 58.8 in April. This was a better number than the expected 58.6. It is also an important figure, since the sector is the biggest employer in Australia. Further, according to the statistics agency, building approvals rose by 17.4%.

Other flash numbers have been positive for Australia. For example, this week, iron ore prices surged to an all-time high because of the huge demand from China. Similarly, media reports have suggested that activity in most cities has returned to normal while the government has continued to ramp up vaccinations. Also, house prices have surged. Indeed, the Reserve Bank of Australia (RBA) upgraded its overall outlook for the economy when it delivered a hawkish statement yesterday.

The AUD/USD is also rising after Janet Yellen walked back her comments that interest rates needed to rise to prevent the economy from overheating. She said that she was not recommending or asking the Fed to hike. Still, many traders have started to consider the possibility of higher rates in the near term.

Later today, the AUD/USD pair will react to the US Services PMIs and the employment estimates by ADP. The data will come two days before the official non-farm payroll numbers.

AUD/USD Forecast

The AUD/USD pair declined to 0.7675 yesterday after Janet Yellen’s comment. This was the lowest it had been since April 14. On the two-hour chart, the pair then bounced back above the important resistance at 0.7698, which was the lower side of the rectangle pattern. It is also attempting to rise above the important 25-day and 50-day weighted moving averages (EMA). The Relative Strength Index (RSI) has also started rising. The outlook for the pair is still bearish. It will likely decline back to the 0.7700 support level.