Bullish View

- Set a buy stop at 0.7862 (Friday high).

- Add a take-profit at 0.7950 and a stop-loss at 0.7800.

- Timeline: 1-2 days.

Bearish View

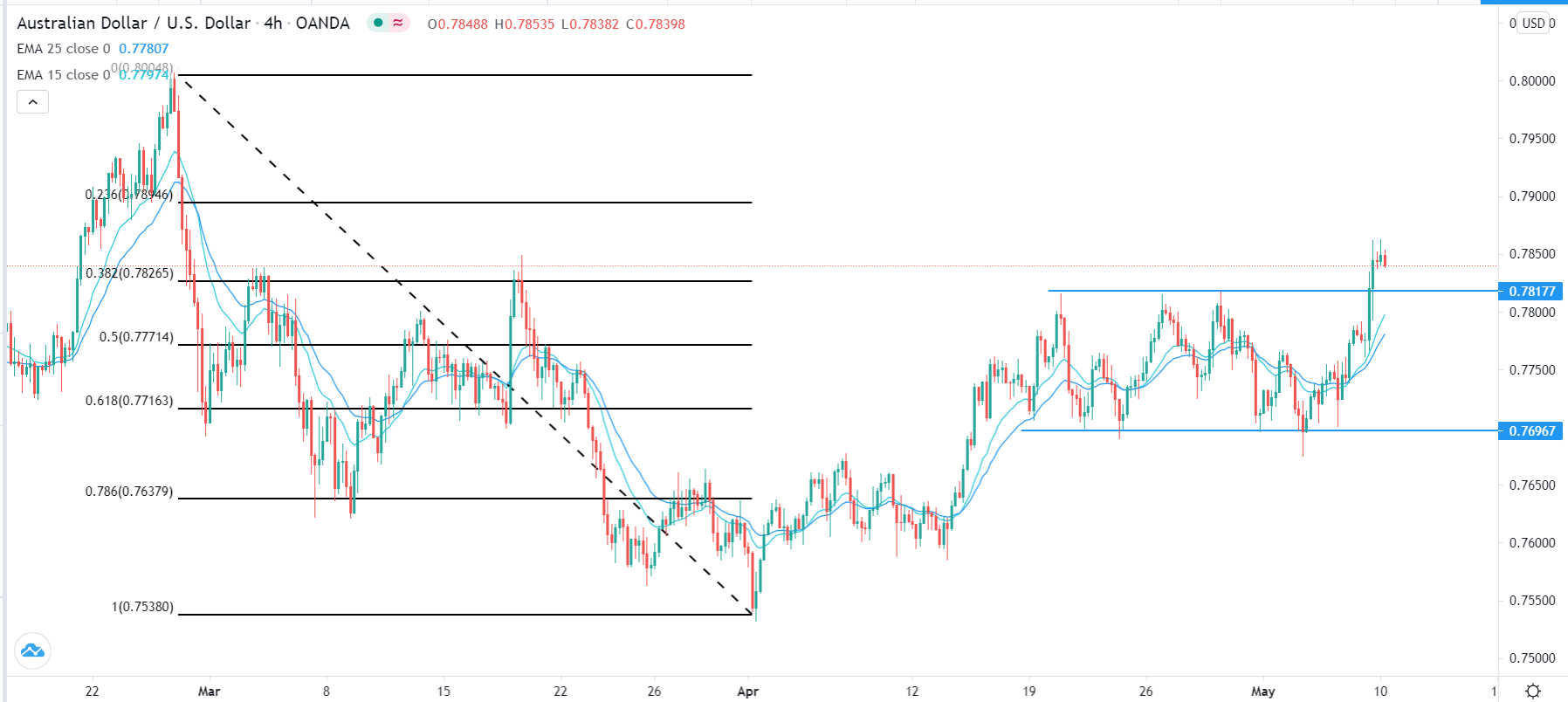

- Set a sell-stop at 0.7817 and a take-profit at 0.7770.

- Add a stop-loss at 0.7900.

The AUD/USD is hovering near the highest level since March 18 this year after the disappointing US jobs data and as commodity prices surge. It is trading at 0.7840, which is a few pips below 0.7862, its highest point on Friday.

Commodity Prices Surge

Australia is endowed with vast natural resources like copper, coal and iron ore. As such, the Australian dollar tends to do well when commodity prices rise. Today, the prices of its key commodities surged as demand from China and other Asian countries remained steady. Iron ore futures jumped by a whopping 10% today, extending the gains made since March last year.

Just last week, the prices moved above A$200 for the first time on record. Indeed, the closely-watched Bloomberg Commodity Index (BCOM) has also surged close to its all-time high. Other commodities that have surged recently are copper, which is close to its record high and crude oil. As a result, the S&P ASX 200 Index is hovering near its all-time high led by companies like BHP and Rio Tinto.

The AUD/USD is also holding steady after the latest Australian retail sales numbers. According to the Bureau of Statistics, sales declined by 0.5% in the first quarter as the country added precautions to curb the virus. The volume rose by 2.4% in December 2020. Online sales represented about 9.4% of the total sales made. This trend will likely continue as the country’s economy continues to recover from the coronavirus pandemic.

Meanwhile, the AUD/USD pair is also reacting to the disappointing jobs data from the United States. On Friday, data by the Bureau of Labour Statistics (BLS) showed that the labour market slowed steeply in April. The unemployment rate rose from 5.9% to 6.0% while some sectors like manufacturing lost workers. This performance is mostly because of the ongoing government stimulus that has made it more lucrative for people not to go to work.

AUD/USD Technical Forecast

For most of last week, the AUD/USD was trading between the support and resistance levels at 0.7696 and 0.7817, respectively. The pair broke out on Friday after the weak US jobs numbers. It rose to a high of 0.7862, which was the highest level since February. It also managed to move above the 38.2% Fibonacci retracement level. Further, the price is slightly above the 25-day and 15-day moving averages. Therefore, the pair will likely retreat slightly and then resume the upward trend.