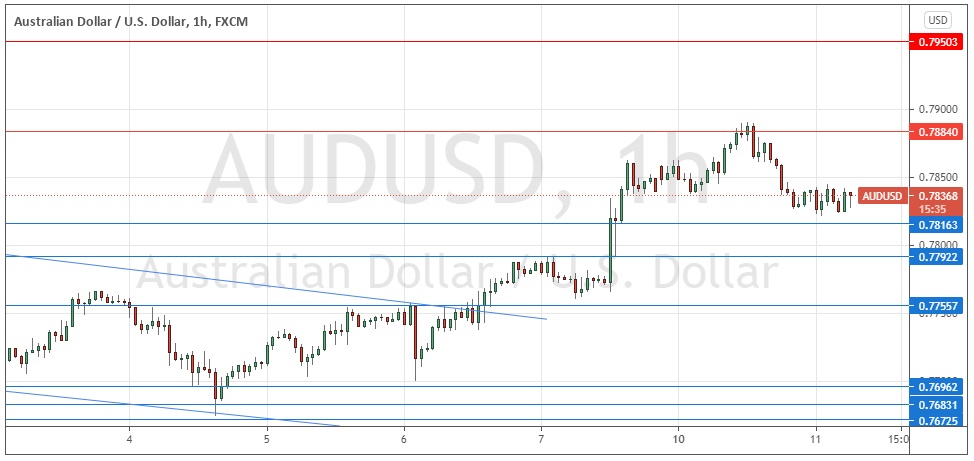

Last Thursday’s AUD/USD signals produced a losing short trade from the bearish rejection of the resistance level identified at 0.7756.

Today’s AUD/USD Signals

Risk 0.75%

Trades must be taken before 5pm Tokyo time Wednesday.

Short Trade Ideas

- Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 0.7884 or 0.7950.

- Place the stop loss 1 pip above the local swing high.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

Long Trade Ideas

- Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 0.7816, 0.7792, or 0.7756.

- Put the stop loss 1 pip below the local swing low.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

AUD/USD Analysis

I wrote last Thursday that the technical picture had become dominated by a symmetrical bearish price channel, which suggested that the price was likely to move lower. I was looking to enter a short trade from a bearish reversal at 0.7756 as the area was confluent with the upper trend line of this bearish price channel.

The short trade did set up but quickly turned into a loss as the price continued to rise. This was the start of an important bullish breakout from the price channel and saw the price eventually break above the long-term resistance level at 0.7816, which now seems to be holding firmly as support. So, although I was wrong, I did correctly identify a pivotal event.

The technical picture remains bullish if the price holds up above 0.7816.

We have seen the nearest resistance level at 0.7884 hold, so I think that this level remains valid.

U.S. dollar weakness seems to be persisting, although it may be pausing, but I see that as meaning that this currency pair remains a good buy from any bullish bounce at 0.7816, we might get today. I will take a bullish bias if this trade sets up.

There is nothing of high importance due today regarding either the AUD or the USD.