Bearish View

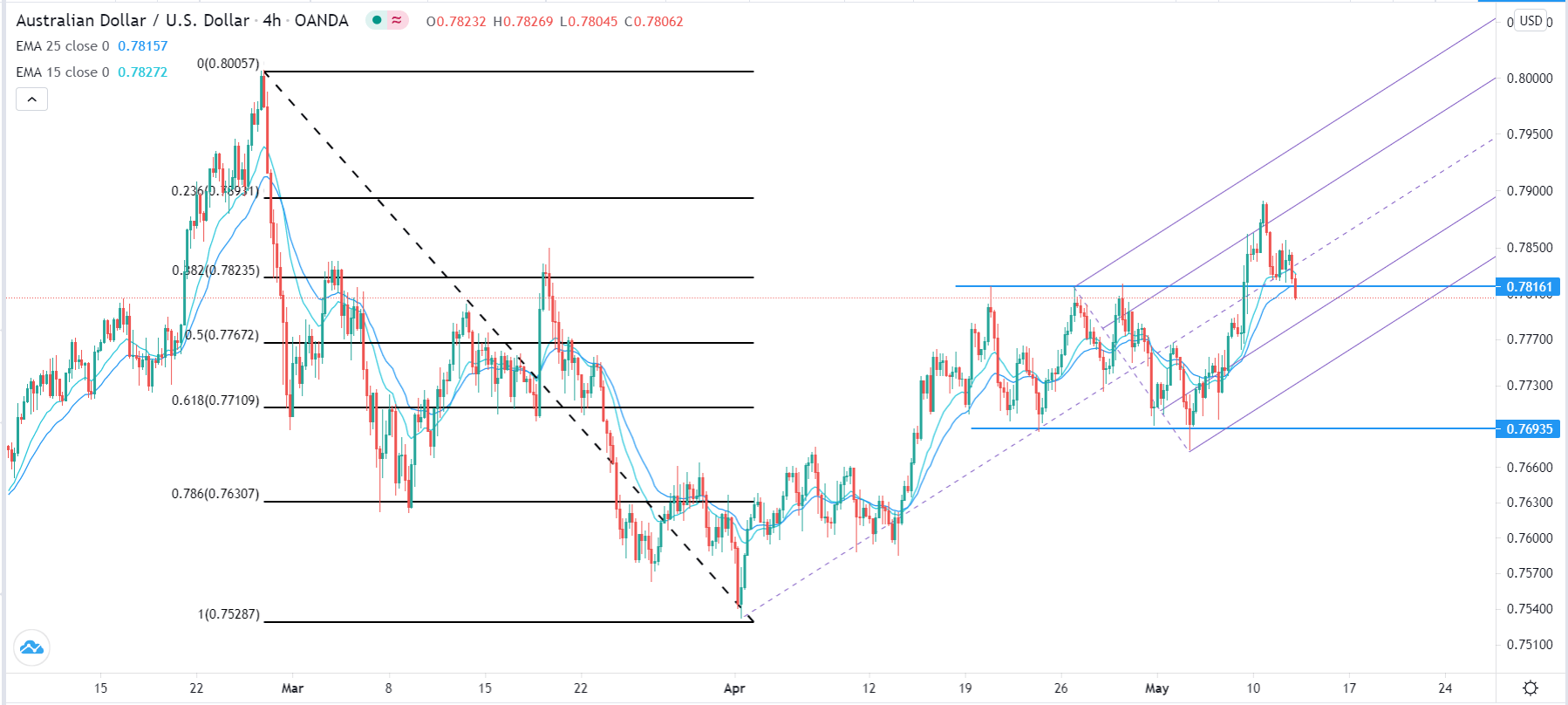

- Sell the AUD/USD and set a take-profit at 0.7710.

- Add a stop-loss at 0.7890 (23.6% retracement).

- Timeline: 1-2 days.

Bullish View

- Set a buy stop at 0.7856.

- Add a take-profit at 0.7900 and a stop-loss at 0.7800.

The AUD/USD price retreated during the Asian session as traders waited for the latest consumer inflation numbers from the United States. The pair dropped to 0.7800, which is 1% below this week’s high of 1.1890.

US Inflation in Focus

The biggest catalyst for the AUD/USD pair is the upcoming inflation data from the United States that will come out in the afternoon session. The data is expected to show that consumer prices rose in April, helped by the recovering economy and the surging commodity prices.

For example, lumber prices have risen more than 350% in the past 12 months. Similarly, other commodities like iron ore and copper have risen to the highest levels on record because of the surging demand from China and the limited supplies. In addition, the cost of shipping has increased while normal bills like utilities have risen for most people.

In general, analysts expect the data to show that the headline Consumer Price Index (CPI) rose by 0.2% on a month-on-month basis. The core CPI is expected to rise by 0.3%. The year-on-year comparison will be not an effective measure of inflation since prices dropped sharply at the start of the pandemic. The pair will also react to the comments by Fed’s Richard Clarida, which will come shortly after the inflation numbers.

The AUD/USD is also retreating as the market continues focusing on commodity prices. As one of the largest commodity exporters in the world, Australia benefits from the rising prices. This is because it attracts more foreign exchange when prices rise. The pair will also react to the upcoming Wage Price Index Data from Australia and US initial jobless claims numbers that will come out tomorrow. The US will also publish the latest Producer Price Index (PPI) tomorrow.

AUD/USD Forecast

The AUD/USD pair has retreated in the past few sessions. On the four-hour chart, the pair managed to move below the upper side of the rectangle pattern. The pair has also moved below the 25-day 15-day exponential moving average (EMA). The price has also moved below the median line of the Andrews pitchfork tool. It has also declined below the 38.2% Fibonacci retracement level. Therefore, the pair may continue dropping as traders eye the 61.8% Fibonacci retracement level at 0.7710. However, a move above the 38.2% retracement level at 0.7823 will invalidate this trend.