Bullish View

- Set a buy stop at 0.7817 and a take-profit at 0.7895.

- Add a stop-loss at 0.7760.

- Timeline: 1-2 days.

Bearish View

- Set a sell-stop at 0.7770 and a take-profit at 0.7700.

- Add a stop-loss at 0.7820.

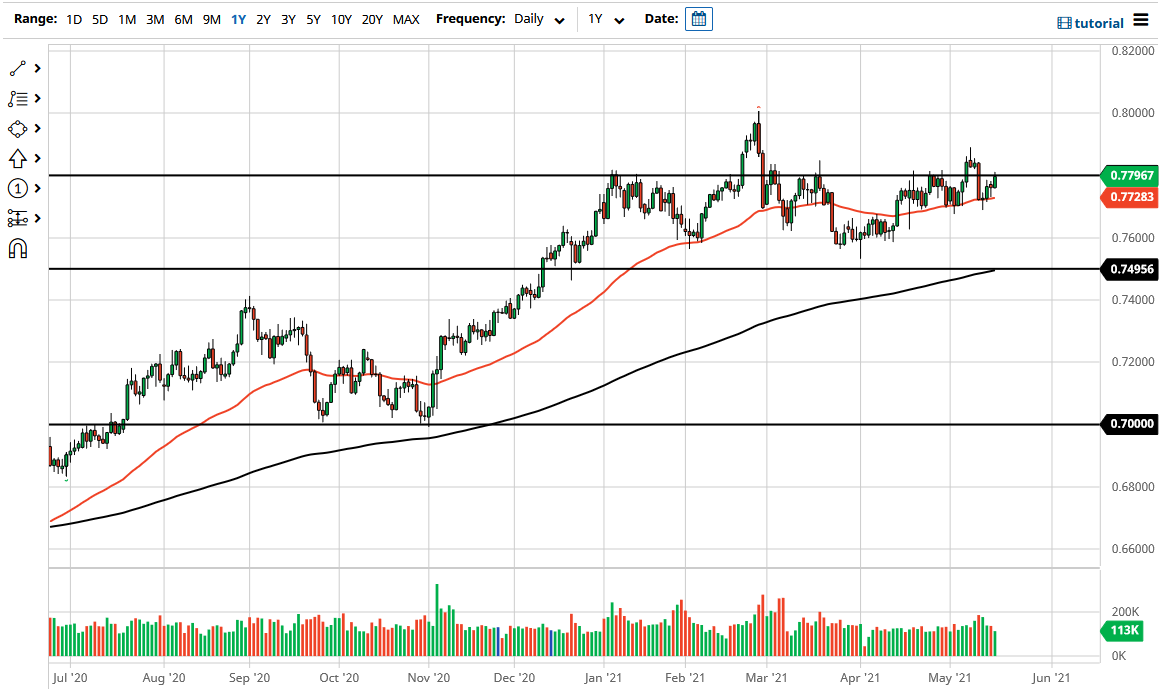

The AUD/USD pair is in a tight range as the market reacts to the ongoing sell-off in commodities and the relatively strong Wage Price Index. It is trading at 0.7787, which is slightly below this week’s high of 0.7814.

Australia Wage Growth

The Australian statistics agency published relatively strong Wage Price Index data. The numbers showed that wages rose by 0.6% in the first quarter. The figure led to year-on-year growth of 1.5%. This was an improvement since the country’s wages saw no meaningful growth in the previous 2 quarters.

The agency attributed the increase to the regularly scheduled increases and improving business conditions. The public sector had the lowest annual growth while the private sector remained at 1.4% for the second straight quarter. These wage numbers are important because they signal the strength of the Australian economy.

The AUD/USD is also reacting to the relatively weak commodity prices today. After rising yesterday, most commodities have started to retreat. For example, the prices of most industrial metals like copper and iron ore have fallen by more than 0.30%. Similarly, the closely watched Commodity Index has declined by 0.60% to the current $92.60.

Later today, the pair will react to the upcoming minutes of the Federal Reserve. In the meeting, the bank decided to leave interest rates and its quantitative easing unchanged. The minutes will likely have minimal impact on the pair since it happened before the US published the recent employment and inflation numbers. After the meeting, several Fed members, including Jerome Powell, argued that the Fed will maintain rates at the current level for longer.

The AUD/USD will also react to the Australian employment numbers that will come out tomorrow. Analysts see the unemployment rate remaining at 5.6% in April.

AUD/USD Technical Analysis

The four-hour chart shows that the AUD/USD pair has found a strong resistance at the 0.7817 level. The pair has struggled to move above this price on four occasions since April this year. It is also hovering around the 25-day and 15-day moving average while the two lines of the MACD indicator have moved above the neutral line. The pair is also slightly above the ascending trendline shown in black. Therefore, the pair will likely break out higher if bulls manage to move above the resistance at 0.7817.