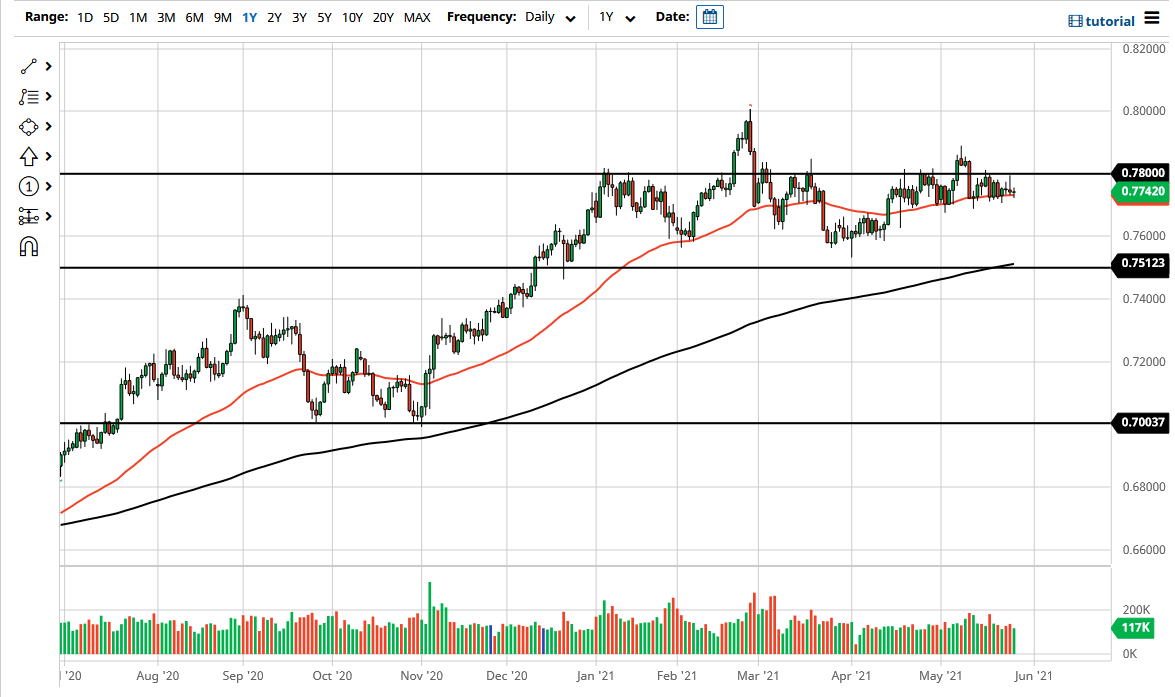

The Australian dollar simply sits at the 50 day EMA yet again during the trading session on Thursday, in a move that will put people to sleep if they pay too much of their attention to it. The 0.78 level above continues to be resistance, but we have pierced that level a couple of times, so I think that means that we could break out much quicker than most people anticipated. However, we would need to see some type of catalyst to make that happen, something that we clearly have not had recently.

For the positive side, if we were to break above the shooting star that sits at roughly 0.79 from a couple of weeks ago, then I believe that the market goes looking towards the 0.80 level which is a major inflection point on the monthly charts that people will be paying close attention to. It is about “100 pips thick”, so if we can break above the 0.81 level, I think that the Australian dollar then becomes a longer-term “buy-and-hold” type of asset. After all, when you look at the monthly charts, this is an area that would be a truly remarkable break out.

To the downside, the 0.77 level continues offer support, but I think the real support level kicks off at the 0.76 handle, extending down to the 0.75 level with the 200 day EMA coming into the picture as well. Breaking down below that level opens up the possibility of a move down to the 0.70 level. This would obviously be a “risk off” move just waiting to happen as the Australian dollar is so highly levered to the idea of the reopening and the commodity trade. However, if we turn around and rally, then it would be a sign that the market is ready to go higher, meaning that we could see a lot of positivity to say the least. With this being the case, I think that what we are looking at here is a scenario where we have to make a move sooner or later, but we have not decided on which direction. I do think that we get that answer relatively soon, but the last couple of months have been a real test of patience, so at this point in time I think you just have to be even more patient and wait for an impulsive candlestick to get involved.