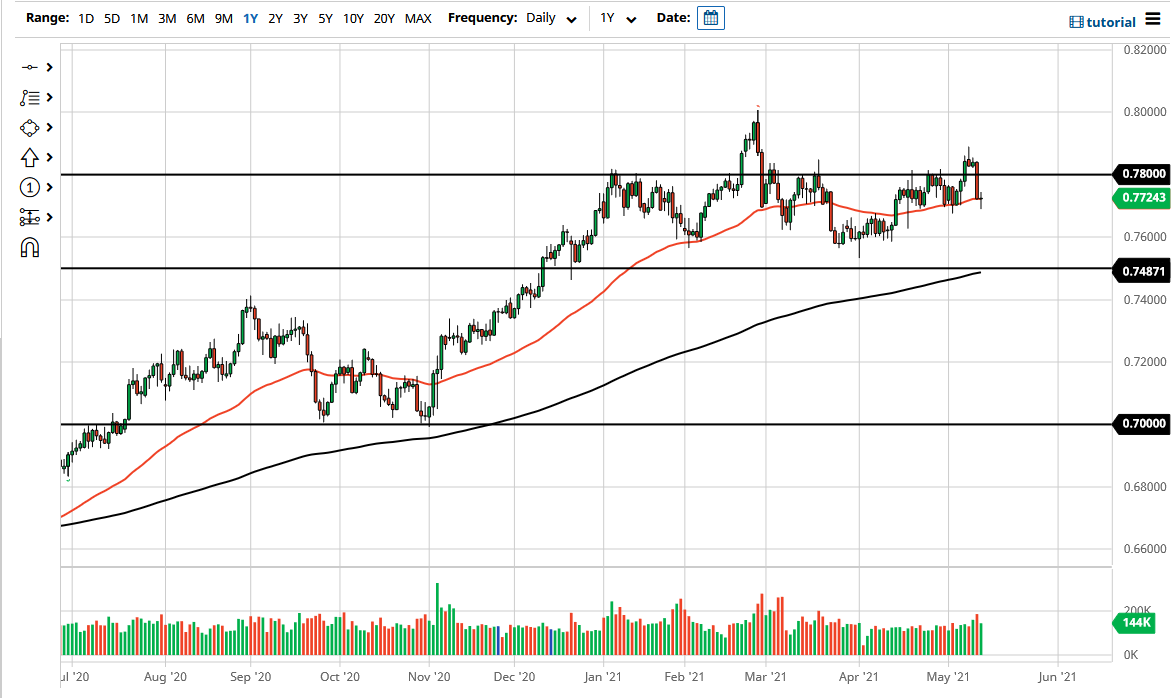

The market forming a neutral candlestick is a good sign considering that the Aussie had sold off so drastically during the previous session. A break above the top of the candlestick for the Thursday session would imply that we are ready to continue the move higher.

The 0.78 level is an area that you will be paying attention to as it was previous resistance, but we did break through it just a few days ago, so at this point in time it is likely to see only a certain amount of resistance. Because of this, I think that the market is likely to go looking towards the top of that shooting star from Monday, and if we can break above there then it is likely that the Aussie will continue to move towards the 0.80 level, an area that I have been calling for recently, and an area that is crucial resistance on the longer-term charts. In fact, it extends to the 0.81 level, and breaking above that makes the Australian dollar a market that I would be more of an investor and, as I think we could go looking towards the 0.88 level, followed by the 0.90 level in that scenario.

On the other hand, if we were to break down below the lows of the trading session on Thursday, we may have to go looking towards the 0.76 level for support. That support extends down to the 0.75 handle, so I think we could be looking at a lot of consolidation in that area but breaking down below it and the 200 day EMA would open up a complete collapse of this market and perhaps even a trend change. At that point I would be looking at a move to the 0.70 level but in general I think what we are looking at is a market that simply trying to find its footing and continue grinding higher in the same manner that it has been over the last couple of weeks as it has been choppy yet positive. The neutral candlestick is bullish, so now all we need to see is momentum continue.