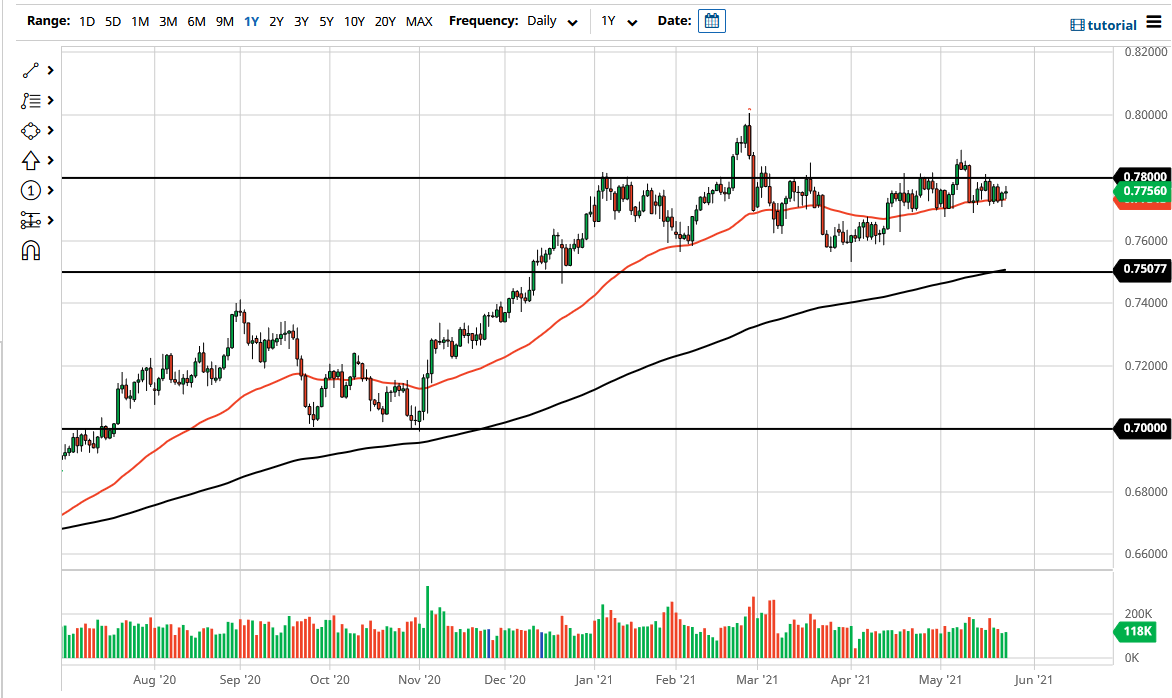

The Australian dollar fluctuated during the trading session on Tuesday as we continue to see a lot of choppy behavior just above the 50-day EMA. The Australian dollar has nowhere to be in the short term, as we seem to have no idea as to what we are going to do for the next big move. It is obvious that there is significant resistance just above the 0.78 handle, but we have not been able to break it with any type of sustainability.

If we can break above the 0.78 level, it is likely that we could go looking towards the 0.79 level next, perhaps followed by the 0.80 level. The 0.80 level is a large, round, psychologically significant figure that we should be paying close attention to, as it is crucial on longer-term charts. If we can break above there, then it opens up the market for a much bigger move as we could go as high as 0.90, based upon the longer-term historical charts. That being said, it is not going to be easy to make that happen anytime soon, so with that in mind, I believe that you have to look at short-term pullbacks as potential opportunities more than anything else.

To the downside, I would suspect that we should see a massive barrier at the 0.76 level that holds the market up. I also believe that barrier extends down to the 0.75 handle, so it is not until we break down below all of that area that I would be a seller. If we break down below there, it could be rather negative and open up a move down to the 0.70 level, but this market has shown absolutely no proclivity to make that happen. It is also worth noting that the 200-day EMA is currently sitting right around the 0.75 level, at the bottom of that overall region of potential support, so keep that in mind as well.

The commodity trade has greatly benefited the Australian dollar on the whole, so keep in mind that the commodity markets should be watched especially close, as the longer-term correlations continue to be nothing worth paying attention to. If we do see a sudden sell-off in this market, it probably would tie in with a major economic situation where we would be running to the US dollar. Right now, that does not look very likely.