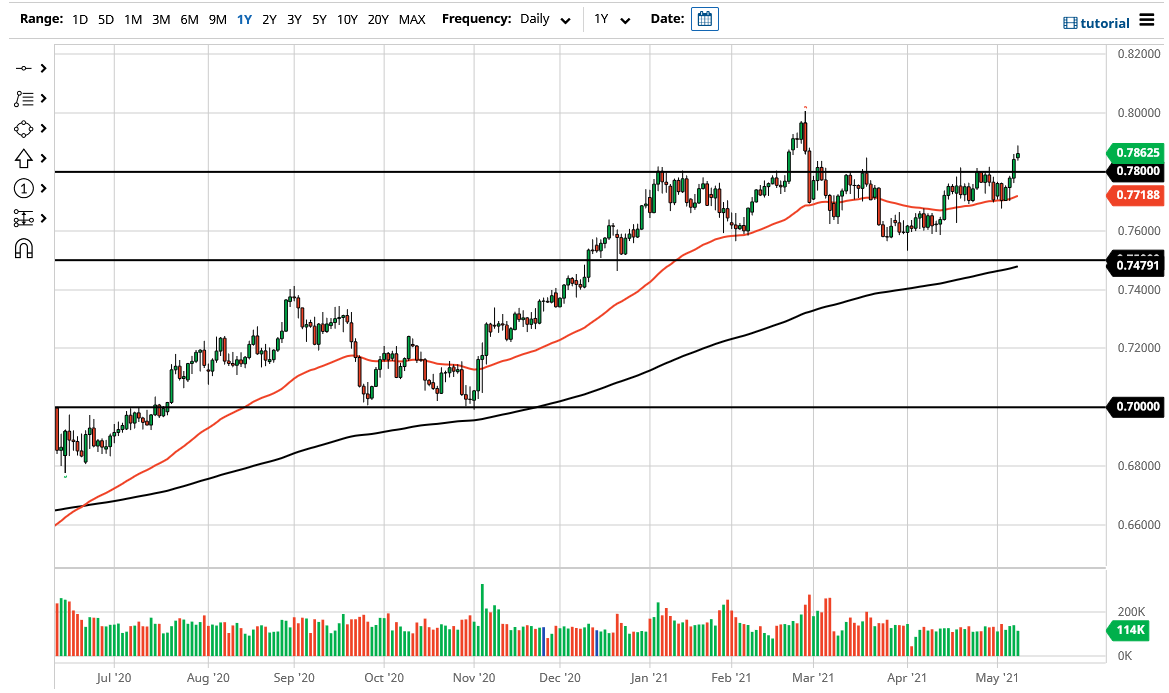

The Australian dollar rallied significantly during the trading session on Monday but gave back the gains quite rapidly. By forming the shooting star that we have, it does suggest that the Aussie is probably going to pull back in order to test support underneath at the 0.78 level to continue the upward momentum. After all, this is an area that had been such a massive resistance barrier previously that it makes that it should now offer a bit of a “floor in the market” for the uptrend.

However, the 0.80 level is a significant large round number that a lot of people would pay close attention to, as it has been important more than once on the monthly chart. In fact, the market sees resistance extend all the way to the 0.81 handle, which is a huge opening for longer-term “buy-and-hold” type of investors that would be a good move all the way to the 0.90 level. I do not necessarily think that will happen right away, but longer term that might be the overall goal of traders.

In the meantime, I believe that the market probably will continue to see a lot of support underneath near the 50-day EMA as well, so I think any type of pullback will likely only encourage traders to get involved with the overall uptrend. It took a lot of effort to break above the 0.78 handle, so a pullback to that area should attract quite a bit of an inflow. I have no interest in trying to short this market based upon this recent break out, but if we did fall below the 200-day EMA, which is currently near the 0.75 handle, then I would consider shorting this market because it could open up a move down to the 0.70 level. That being said, it looks very unlikely to happen anytime soon, especially as the commodity trade continues to be favored by traders in general, and the Aussie is so highly correlated to that. Regardless, I do recognize that the 0.80 level is going to be a massive barrier to overcome, and I do not think it will happen easily, so I would anticipate choppier yet upward trading over the next several weeks.