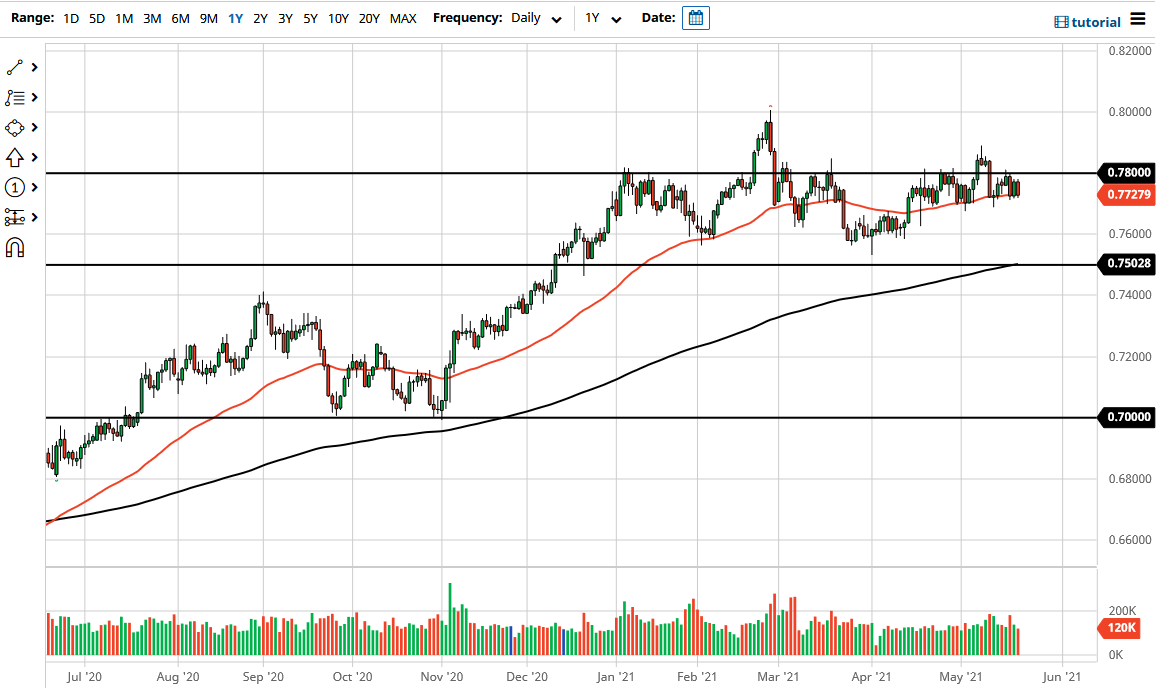

The Australian dollar fluctuated during the trading session on Friday as we continue to sit just between the 50-day EMA and the 0.78 level. The market looks as if it is waiting to go somewhere, but it does not know which direction that is going to be yet. Ultimately, the market is simply killing time until we can figure out whether or not the commodity boom will continue. Furthermore, the Australian dollar has an external problem in the form of China, which is currently arguing back and forth with the Australian government on trade.

The 0.78 level has been resistance that extends to the 0.79 level. If we can break above there, then the market is likely to go looking towards the 0.80 level, an area that is important on longer-term charts, so I think that what we are looking at is a scenario that could kick off the next shot higher if we can get above there. If we do, then it is possible that we could go looking towards the 0.90 level. Nonetheless, that is something that would take a lot of work to get towards, so it is just something to keep in the back of your mind.

Currently, I believe that we are going to continue to see this choppy behavior continue, thereby allowing the back and forth and short-term, range-bound trading to be the mainstay. The Australian dollar is getting a bit of a boost due to the fact that the US dollar itself is under a lot of pressure, but the fact that it could not go higher does suggest to me that perhaps we are already fully priced into the market when it comes to the global reopening trade. If you look at the US stock market, it certainly seems as if that might be the case.

Regardless, I have no interest in shorting this market until we break down below the 0.75 handle, which could open up a 500-point drop. While that does not seem to be very likely to happen, it is most certainly something that could happen, so you need to keep it in the back of your mind. I think you should just simply trade this pair back and forth until it tells you not to do so.