The Australian dollar broke down significantly during the trading session on Wednesday as inflation numbers in the US came out much hotter than anticipated. While CPI numbers were expected to come in at 0.2% for the month of April, the United States produced the 0.8% number. This had people jumping into the US dollar against various currencies, especially some of the ones that had recently been a bit hot.

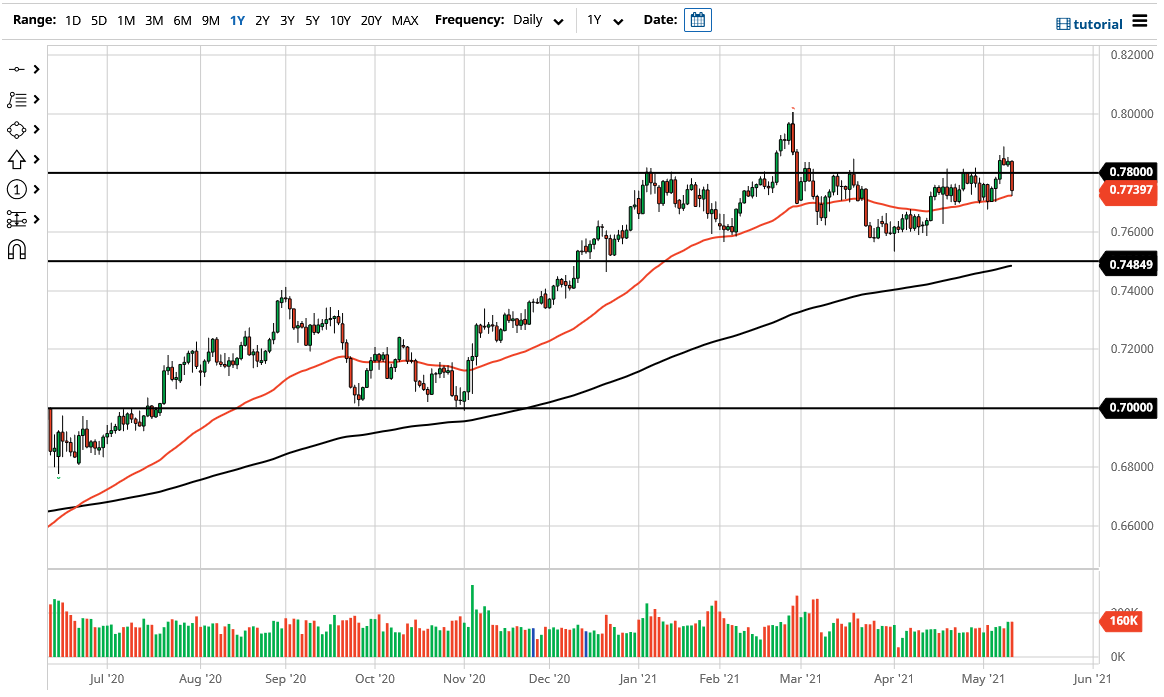

The 50-day EMA underneath was tested, and that is right where we stopped. Furthermore, there is a certain amount of support just below, so I do think that buyers will probably come back into the equation. Nonetheless, when you take a look at what is fundamentally driving the United States dollar, it is the idea of the Federal Reserve staying loose for longer. However, this hotter-than-anticipated inflation number had people betting that the Fed would have to tighten quicker than they have stated publicly.

Nonetheless, when you pay attention to the words of the people who make the actual decisions, they have stated more than once that they expect inflation to be “transitory” in the United States, and then it could run a little hotter than anticipated. In fact, they have even stated that they are perfectly comfortable letting inflation run “above target for a while” in the words of Jerome Powell. With that in mind, I think that it is only a matter of time before traders begin to realize that the Federal Reserve is not going to be swayed by one month’s data. All that being said, if we were to break down below the 0.75 handle it could very well send the trend to the downside, which would coincide with a couple of shooting star-shaped candlesticks on the monthly chart, but this pair has been so resilient that I do not anticipate this happening anytime soon. With that in mind, I am looking for short-term dips as buying opportunities, and it looks like we are about to see that relatively soon. I think that the barrier that starts at the 0.76 level is a massive floor more than anything else. We may be able to break down below the 50-day EMA based upon the fact that we have closed towards the bottom of the range for the trading session.