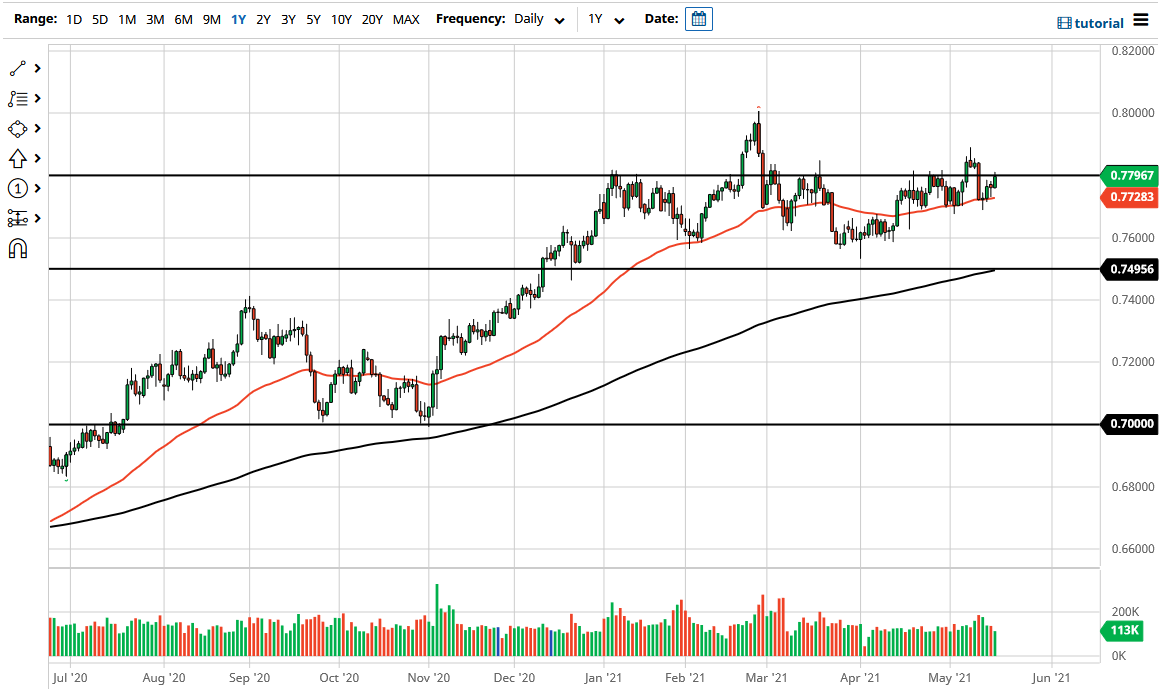

The Australian dollar initially fell on Monday only to find buyers again at the 50-day EMA. The 50-day EMA is an indicator that a lot of people will pay attention to, as most will use it as a short-term trend indicator. As you can see on the chart, the last month or so we have seen this market pay particular attention to the 50-day EMA, so the fact that we ended up forming a little bit of a hammer during the trading session is probably not a huge surprise.

Now that we have formed this hammer, it suggests to me that the market is going to try to get to the 0.78 level and beyond. I recognize that this is a market that is in an uptrend, so it is very likely that we will see buyers every time it dips anyway. The Australian dollar is very highly sensitive to the commodity markets, which are starting to see a lot of inflows due to the “reopening trade” that everybody else is banking on. Furthermore, we also have the US dollar falling in general, so that should continue to put upward pressure on this market as well.

To the upside, I see the 0.80 level as a major resistance barrier that extends to the 0.81 handle. I do think that we could make a serious attempt to break above there, but it probably will not happen from a sudden move. I think this is going to be the goal of the pair over the course of the summer, to break above that level, so that it can continue to go higher. If we do get above the 0.81 handle, at that point I would anticipate the Australian dollar reaching towards the 0.90 level above.

Even if we do break down a bit, I think there are plenty of buyers underneath, with the area between the 0.76 and the 0.75 levels being a massive support barrier, which is going to be supported by the 200-day EMA as well. If we break through all of that, it will change everything, but we would need some type of major “risk off event” to have that happen from everything that I see globally right now.