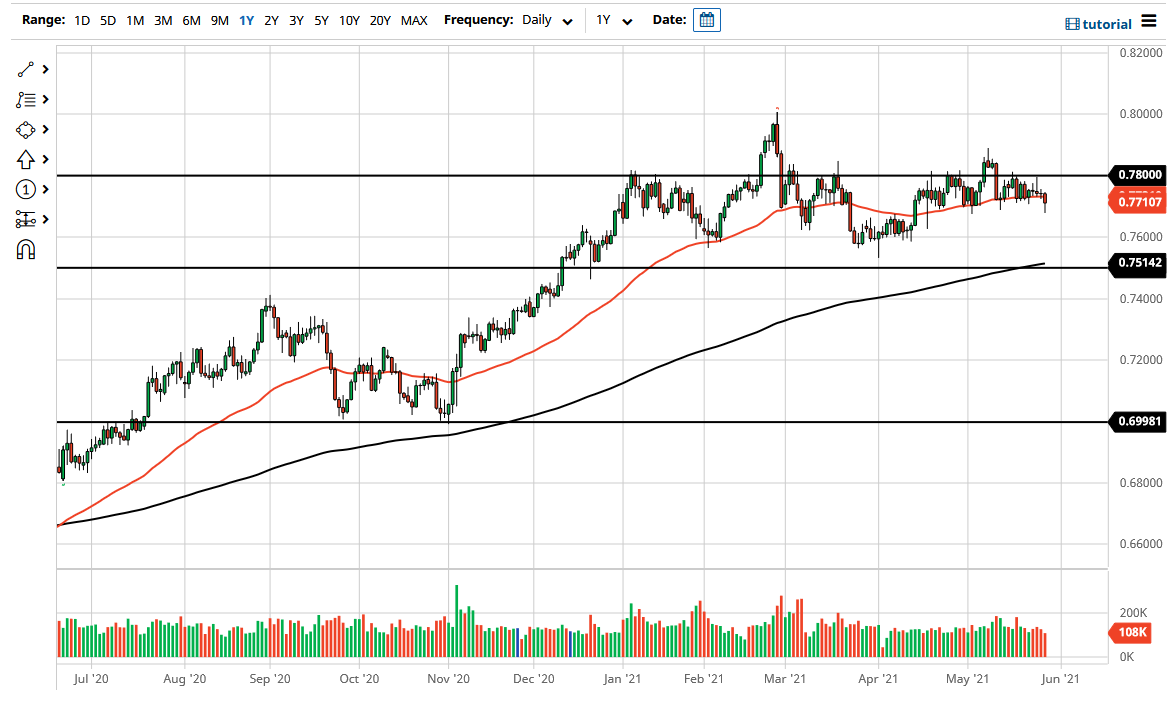

The Australian dollar initially fell during the trading session on Friday but found support below the 0.77 handle again. By doing so, it looks like we are going to continue the same action that we have seen for the last couple of months. The Australian dollar has been horrible to trade unless you are a short-term trader and are willing to take advantage of range-bound markets.

If that is the case, then you have an area just below the 0.77 handle that offers a lot of support, just as the area just above the 0.78 level offers a lot of resistance. This does make a bit of sense, due to the fact that the Australian dollar is so highly correlated to the commodity trade and the entire reopening situation, as commodities are a major component of that. Furthermore, we also have to pay attention to the Australian market itself, as Australia is currently in a bit of a trade spat with China, perhaps suppressing price a little bit. For what it is worth, there are also new lockdowns in Australia again.

To the downside, if we break down below the bottom of the candlestick for the trading session on Friday, then it could open up a move down to the 0.76 level, which is a large, round, psychologically significant figure that extends down to the 0.75 level where I see the 200-day EMA rising. This should continue to offer a certain amount of support, and I think what we are looking at is a scenario where people will be looking to take advantage of value on dips. I do not necessarily think that we are going to break down, but if we were to clear the 0.75 level to the downside, that could really open up the floodgates.

I suspect that we are going to see more of the same type of action that we have seen over the last couple of weeks, especially as we approach the jobs number on Friday. Remember that Monday is Memorial Day, so that will probably take some of the volatility and momentum out of the market as well. With that being said, I believe this is a market that has to be paid attention to, but not necessarily traded right now.