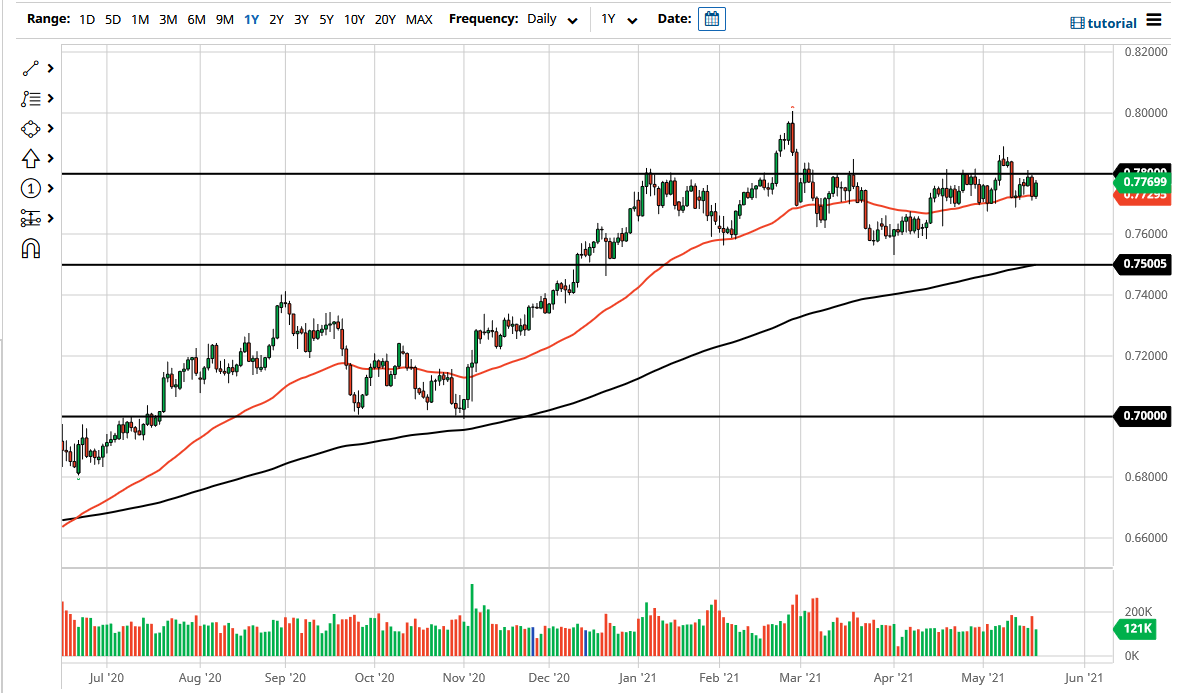

The Australian dollar has rallied again during the trading session on Thursday as we continue to see the 50 day EMA offer a significant amount of support. The 50 day EMA has held true as support from April 19, as every time we have tried to break down below there, buyers have jump back in to push this market towards the 0.78 level. At this point, it seems like markets simply have nowhere to go, but it makes quite a bit of sense that the market is trying to digest the massive amount of gains that we had recently had.

If we were to break above the 0.78 handle, then it is likely that the market could go looking towards the 0.79 level again, which is where we had pulled back from rather significantly. I do like the idea of taking advantage of value when it occurs, but you also have to be willing to accept the fact that we have no real directionality at this moment, as the Australian dollar is highly levered to the reopening trade which may have gotten a bit ahead of itself.

If we were to break down below the 50 day EMA, then the market could go looking towards the 0.76 handle. The 0.76 level is the beginning of major support that extends down to the 0.75 handle. That is a major support level that is now starting to be backed up by the 200 day EMA. Because of this, if we were to break down through all of that then I believe that the Australian dollar could start to sell off quite significantly down towards the 0.70 level. While not my best case, it is something that has to be kept in the back of your mind.

More likely than not, I believe that the market will continue to grind to the upside, perhaps trying to reach towards the 0.80 level above. That is a large, round, psychologically significant figure that a lot of people will be paying close attention to, as it is important on the monthly charts, so I think that if we can start to take off above there, and perhaps break through the 100 PIP range of resistance to the 0.81 handle, then the market is likely to go looking towards the 0.88 level, and then possibly the 0.90 level.