The crude oil markets have been a bit rattled over the last couple of sessions as we continue to see demand destruction coming out of India. With the rising coronavirus cases, there are a lot of concerns as to whether or not the world’s third largest importer of crude oil will start to taper off purchases. If that is going to be the case, then obviously it will have an effect on the market given enough time. That being said, it should be noted that the WTI grade of crude oil typically is not used in that part of the world, although a glut of other grades of crude could have a “knock on effect.”

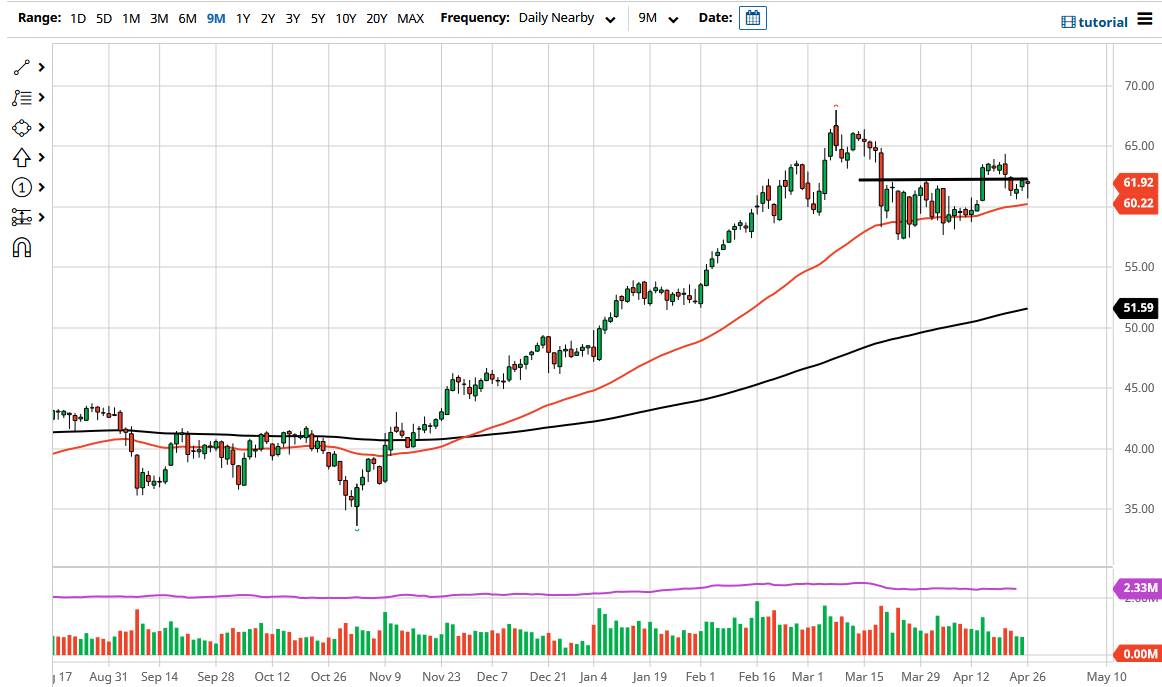

The 50-day EMA sitting just below offers psychological support if nothing else, as we did up forming a bit of a hammer. That hammer is a good sign, so if we can break above the $62.25 level again, I do believe that this market will probably try to get back to the $64.50 level above, where we had topped out last week. Above there, we have the $65 level, which could be thought of as potential resistance, or even just the simple target. We have seen selling in that area previously, so this would not be a huge surprise.

Ultimately, this is a market that I think will eventually try to find a reason to make a move higher, but right now we just do not quite have it. The Federal Reserve has a meeting over the next couple of days, which could have an influence on the US dollar, so that in and of itself could be part of the reason why we move. With the greenback getting hammered the way it has been lately, it would not be a surprise at all to see commodities rise based upon that idea alone. Furthermore, it is obvious that the narrative right now is about “pent-up demand”, although that will be short-lived.

If we do break down below the $60 level, then you might see a little bit more profit-taking and/or selling. At that point, I would anticipate that the market will probably go looking towards the 200-day EMA underneath, although that is not my best-case scenario at the moment. With this, I remain somewhat ambivalent towards this market but recognize that the upside is the most likely scenario.