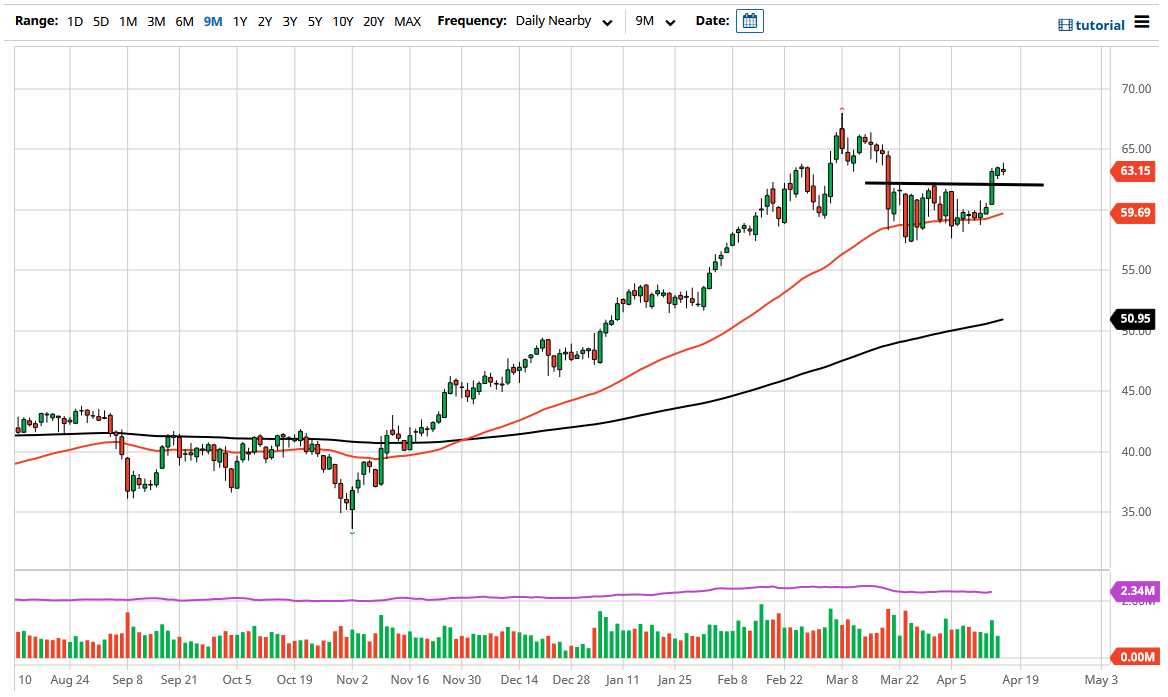

The West Texas Intermediate Crude Oil market went higher initially during the trading session, but then gave back the gains to form a shooting star. The shooting star is a negative sign, and that could send this market lower. However, I do think that there is a significant amount of support underneath that will continue to lift the market.

Over the last couple of days, we have had OPEC and the IEA come out and suggest that demand would continue to go much higher. If that is going to be the case, that should drive the value of crude oil higher, so at this point it is likely that the market will eventually find reasons to go higher, but that does not mean that it is going to be easy. Pullbacks at this point not only have support near the $62.50 level, but also at the $60 level where the 50-day EMA is starting to approach.

If we break down below there, then everything changes, and it is likely that the market will go much lower. That being said, I do believe that the market will continue to be very choppy and volatile, and it is also possible that we may turn around to break towards the upside. By doing so, the market has the $65 level in its sights, but after that we could be looking at $67.50 level given enough time.

If we get to that level, then it is possible that we may break out and go looking towards the $70 level. The $70 level is a large, round, psychologically significant figure, so I think a lot of people would be jumping into the market to try to push it even higher. That being said, this is a market that is starting to show signs of weariness, so it could roll over due to that alone. After all, the economy is certainly a bit of a question at this point, and that will influence whether or not the crude oil market can continue to go higher, or if it is going to suffer at the hands of some type of economic shock and coronavirus lockdowns.