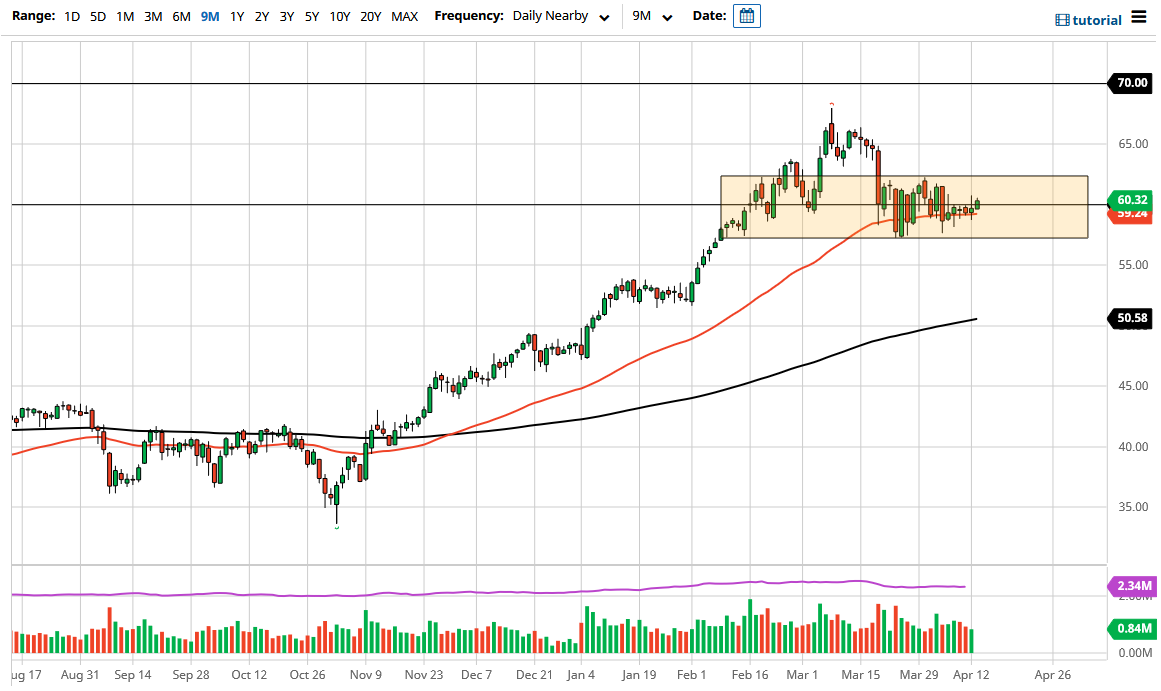

The West Texas Intermediate Crude Oil market has done very little during the trading session on Tuesday yet again, as we continue to bounce around in the same action that we have seen for some time. That being the case, I think the market is very unlikely to provide any type of clarity without an external catalyst, something that I do not know that we are getting in the short term.

Currently, we sit just above the 50-day EMA, and it would make sense that traders will pay close attention to that indicator, because it is so widely followed in general. With that being the case, and the fact that we are sitting right at the $60 level, I think we will continue to see very noisy trading for most of the week as we simply kill time and try to figure out where we go next. Ultimately, this is a market that will eventually break through the $62.50 level and go higher, or break down below the $57.50 level and continue down.

If we get the move lower, then it is likely that we will go looking towards the $52.50 level, via the $55 handle. On the other hand, if we rally, then crude oil is likely to go looking towards the $65 level above, which would offer quite a bit of short-term resistance. Nonetheless, I think what we are seeing here is a market is trying to figure out where it will go next, and then follow right along. The market is likely to be very noisy, but that is nothing new for this commodity.

If you are a short-term scalper, this might be the market for you. Otherwise, you could play the roughly 5-dollar range that we are in, but even that is probably going to be somewhat difficult. This is a market that I am staying away from, but if you are a short-term focus trader it might be the best place for you to be involved. I do think that eventually we will get the move, and once we do it should be relatively obvious, but until then I remain on the sidelines, although one would think that a lot of what is going on has to do with whether or not the “reopening trade” continues to be en vogue or not.