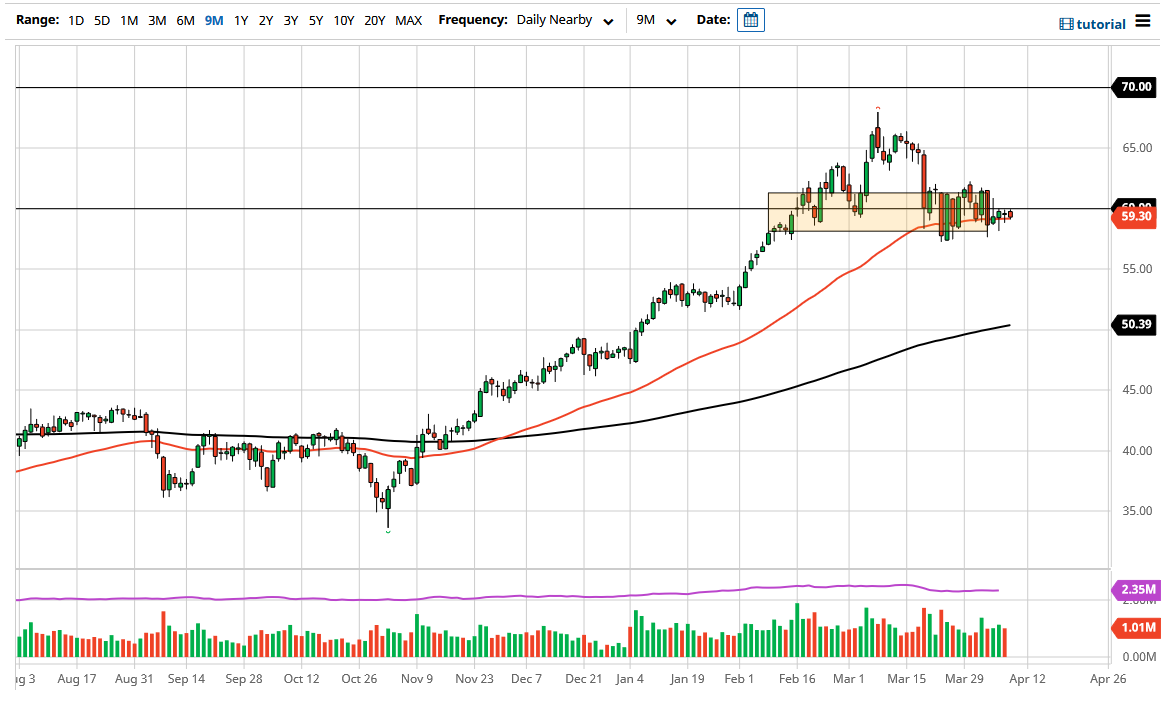

The West Texas Intermediate Crude Oil market has rallied over the last couple of days, but Friday was a bit different as we pulled back. Perhaps traders are looking to simply square positions heading into the weekend to avoid any type of exposure. After all, we are still waiting to see whether or not the market is going to take off, and the last thing most traders want to do is see a major gap go against their position at the open.

To the downside, I see the $57.50 level as support, opening up a move down to the $54 level. The $62.50 level above is significant resistance, so if we were to break above there then it is likely that the market could go looking towards the $65 level. That is an area that I think would continue to see a significant amount of resistance, where we have seen a lot of selling. At this point, the market is still very much in a significant uptrend, so that is something that we need to pay close attention to. However, a breakdown below the support level at the $57.50 level could pull back towards the $54 level.

Crude oil is going to continue to be very noisy, as we are starting to take a look at the economy and whether or not we will continue to see a lot of growth and strength due to the reopening situation. However, at the same tim,e we also have OPEC out there talking about increasing production slowly over time, so that could make the market struggle just a bit. With that being the case, I think that the market is going to continue to see volatility in general, so at this point the 50-day EMA is a good proxy for what is going on, as we are simply going flat.

Eventually, we should see some type of decision made, in the form of a daily candlestick that is impulsive. If we see the move, we simply follow. At this point, that is about all you can do in the market right now, as it looks like it is coiling up for a bigger move. Ultimately, it is a simple matter of waiting for the market to tell you which direction it is going to go in.