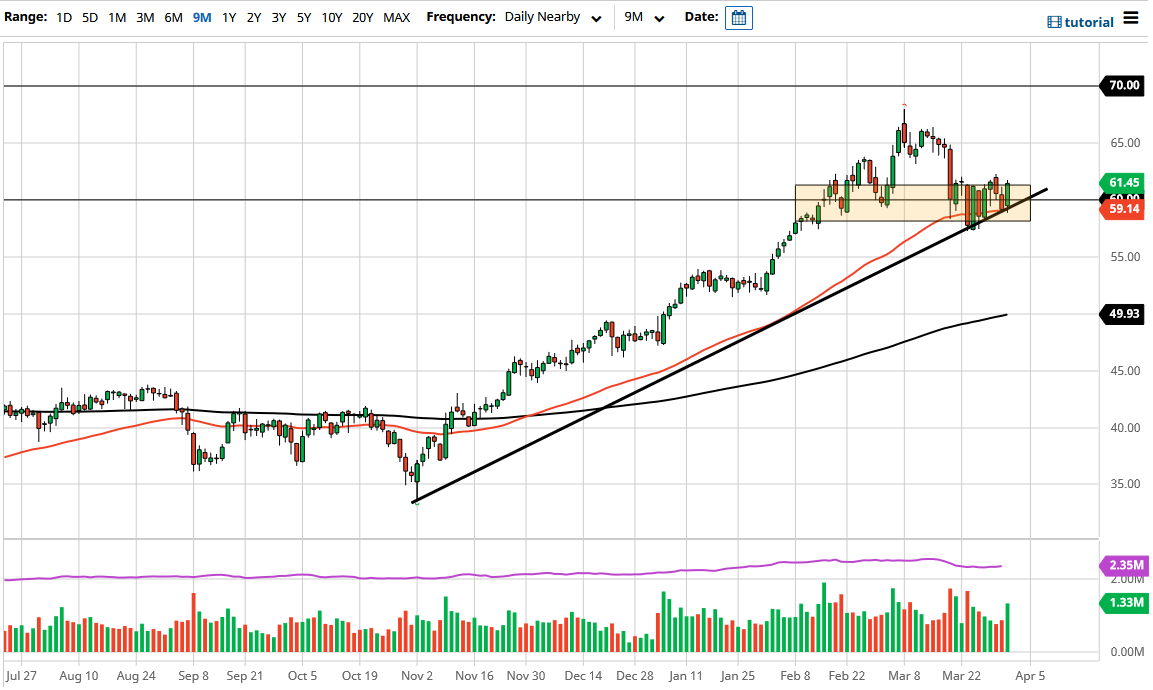

The West Texas Intermediate Crude Oil market has been back and forth in general, and it now looks as if we are continuing to hang onto the 50 day EMA. The 50 day EMA of course is a major technical indicator that a lot of people will pay attention to, and of course the $60 level will continue to attract a lot of attention as well. The OPEC meeting finally released the announcement that they are in fact going to start increasing production in the month of May, June, and even extend the production further to over 400,000 more barrels in July. It is a gradual increase in production, so it is going to be interesting to see how the market behaves in reaction.

Keep in mind that Friday was Good Friday, so there was almost nobody involved in any of the markets, and of course the futures markets were closed. At this point in time, it is going to be a simple matter of whether or not the market can break above the $62.50 level, allowing the buyers to push this market towards the $65 handle, or if it is going to be a scenario where we break down below the uptrend line underneath and send this market lower. If we do, then it is likely that the market breaks down towards the $55 level, possibly even as low as $52.50 after that.

Looking at this chart, it certainly looks as if we are trying to make a bigger decision as we are grinding back and forth to build significant amounts of inertia. I think at this point we should also pay close attention to the US dollar, because the US dollar can work against the value as well. With this, it is probably best to simply wait until the end of Monday to make a decision, because it will give us an idea as to which direction the market decides it wants to go.

At this point, I think that the market is probably one that you need to be cautious about until it makes its move, but once it does you have a couple of obvious levels to aim for when we get involved either to the upside or the downside. That being said, we are still technically in a very strong uptrend so that is of course something you should keep in the back of your mind.