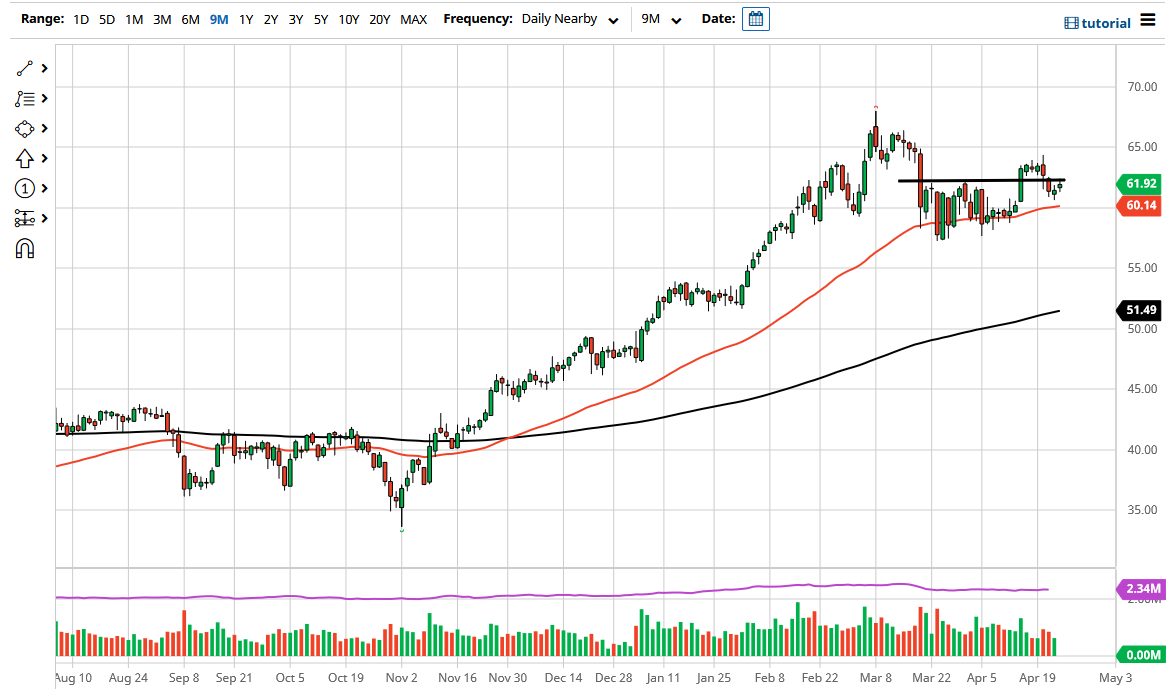

The West Texas Intermediate Crude Oil market rallied a bit during the trading session on Friday again, but it looks like we are seeing the $62.50 level as a bit of a magnet for price, which was where we recently had seen massive resistance. We broke above there, and then broke back down below it again, and now we are testing it to see if it is going to eventually be resistance going forward. I think the one thing you can probably read out of this chart is the fact that the markets are all over the place and have no idea what to do with themselves.

There are concerns of coronavirus figures rising in places like India and Japan, which could weigh upon the demand for crude oil globally. The demand is not so concerning of a situation in the United States, but the knock-on effect from Brent and other versions of crude oil will also have an effect on WTI.

Another thing that will come into play is the US dollar. If it suddenly starts to spike again, that will probably have oil falling. At that point, I would anticipate that the market may go looking towards the 50-day EMA underneath, which is sitting at basically the $60 level. The $60 level is a large, round, psychologically significant figure, so I think there would be a lot of attention in that region. If we break down below there, then the market is likely to continue to break down further.

On the other hand, if we can break above the recent highs at the $64 level, it is likely that the oil market will probably go looking towards $67.50 above. I think the only thing that you can read into this chart right now is that there are a lot of concerns out there when it comes to the reopening trade, and it is also worth noting that inventory numbers have not exactly been a blowout as of late. We have seen crude oil drawdowns, but we are not seeing demand for gasoline that matches, suggesting that perhaps the recovery may not last as long as people had originally thought. In the short term, you probably have more of a range-bound market that you can take advantage of if you are willing to trade shorter-term charts.