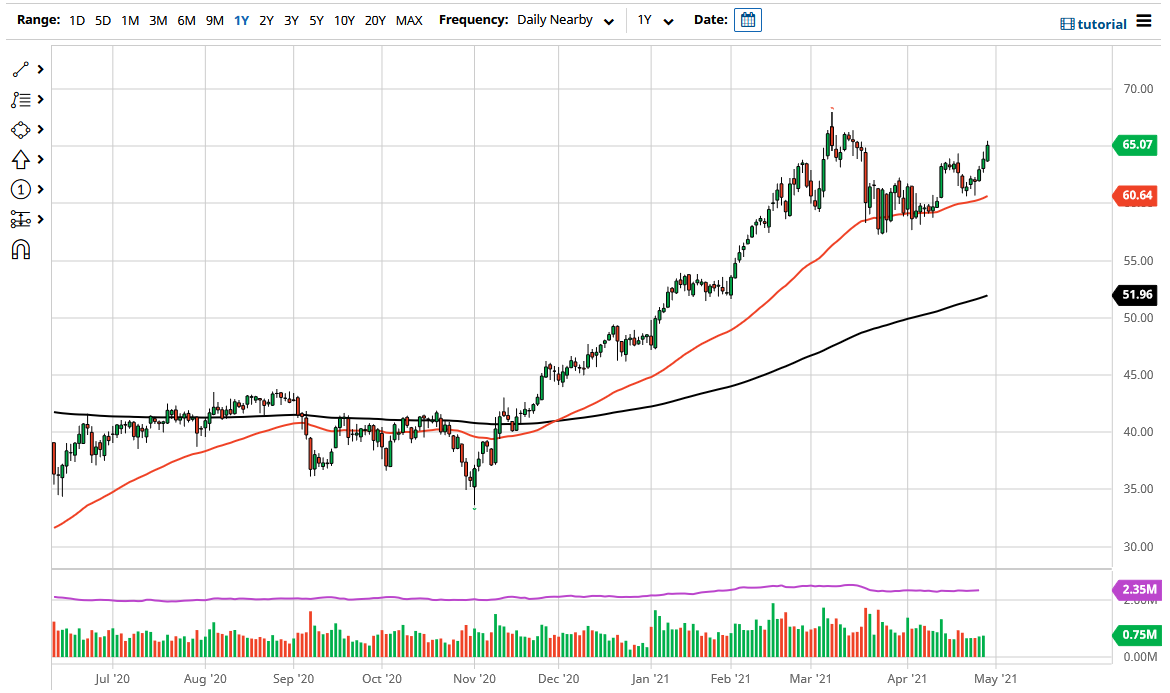

The West Texas Intermediate Crude Oil market has rallied a bit during the course of the trading session on Thursday to test the $65 level. The $65 level of course is a large, round, psychologically significant figure and of course an area where we have seen a bit of selling as of late. The recent selloff from that level never really materialized to a trend change like we thought we could have. When we form that can from a couple of weeks ago, it look like we were going to collapse below the $60 level, but that never really panned out.

It should be noted that the 50 day EMA has offered dynamic support and is starting to go higher. Ultimately, the market is likely to go looking towards the $67.50 level, which where we had seen the previous resistance. If we can break above there, the market will probably go looking towards the $70 level which of course has a certain amount of psychology attached to it. Breaking that level opens up a much bigger move to the upside.

Keep in mind that both OPEC+ and British Petroleum have announced that they expect a build in demand of roughly 6 million barrels a day going through the rest of the year, and I think at this point in time traders are trying to price that in. Yes, we had reached rather high levels rather quickly, but at the same time we have simply been trying to work off some of the excess froth from what had been an extraordinarily large move to the upside from the lows. Now that the world is focusing on the “reopening trade”, it is very likely that we will continue to see crude oil at least be favored, if not bullish overall.

Some pundits have even suggested that crude oil should hit $80 a barrel later this year, which at this rate would not be a huge surprise, but I am a little bit more conservative in my estimate of it trying to reach the $70 level. That is not to say that I do not think it can go higher, just that right now I am not willing to protect that far into the future, as US shale producers are starting to jump online again.