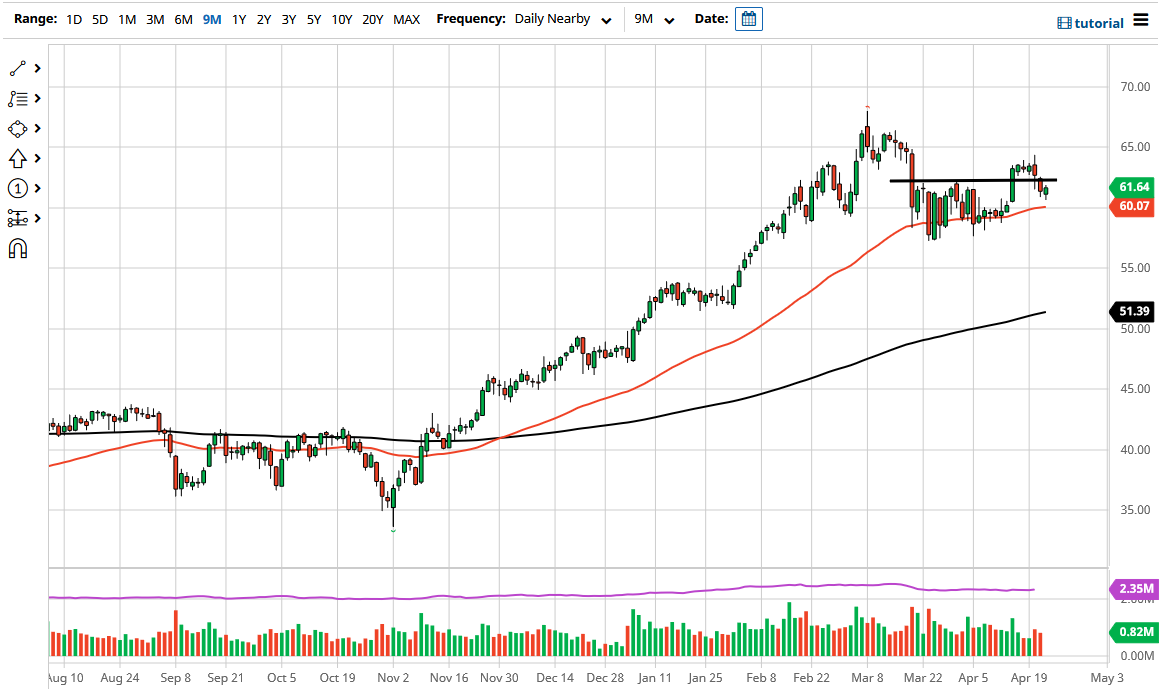

The West Texas Intermediate Crude Oil market fell significantly at the open on Thursday, but then turned around to show signs of life again. By doing so, the market is probably setting up for some type of bounce, but it is worth noting that we found support just above the $61 level as well. The 50 day EMA is starting to reach towards that area as well, so there are a host of factors coming into play.

One thing that is difficult to come to grips with this fact that the inventory numbers are starting to show signs of demand destruction, which of course is something that is worth watching, because if that continues, sooner or later this could see a significant break down. In the short term though, it looks like that $60 level and the 50 day EMA are going to come into play as well, so the fact that we turn around and bounced during the session probably is not a huge surprise for the day. At this point time, the market is likely to continue to see a lot of noise at the $62.50 level, which was previous resistance that did offer support initially, but then failed. In other words, we are all over the place and it is clear that we will continue to chop back and forth.

The $65 level above looks extraordinarily resistive, so I think at this point it would be very difficult to break above there. If we did, then it would be a very bullish sign for a longer-term move, but right now it looks like it is very difficult to make that happen. Furthermore, there are a lot of concerns when it comes to the coronavirus in various places around the world including Japan and India, and therefore if those numbers continue to rise, demand for crude oil will certainly be dampened. In fact, India is the world’s third-largest crude oil importer, and it has some of the highest infection rates that it has ever had. Because of this, I do believe that we will continue to see choppy behavior and you will have to look at the chart from a short-term perspective, as we clearly will have major issues. Because of this, I think that the market is something that you should be very cautious about.