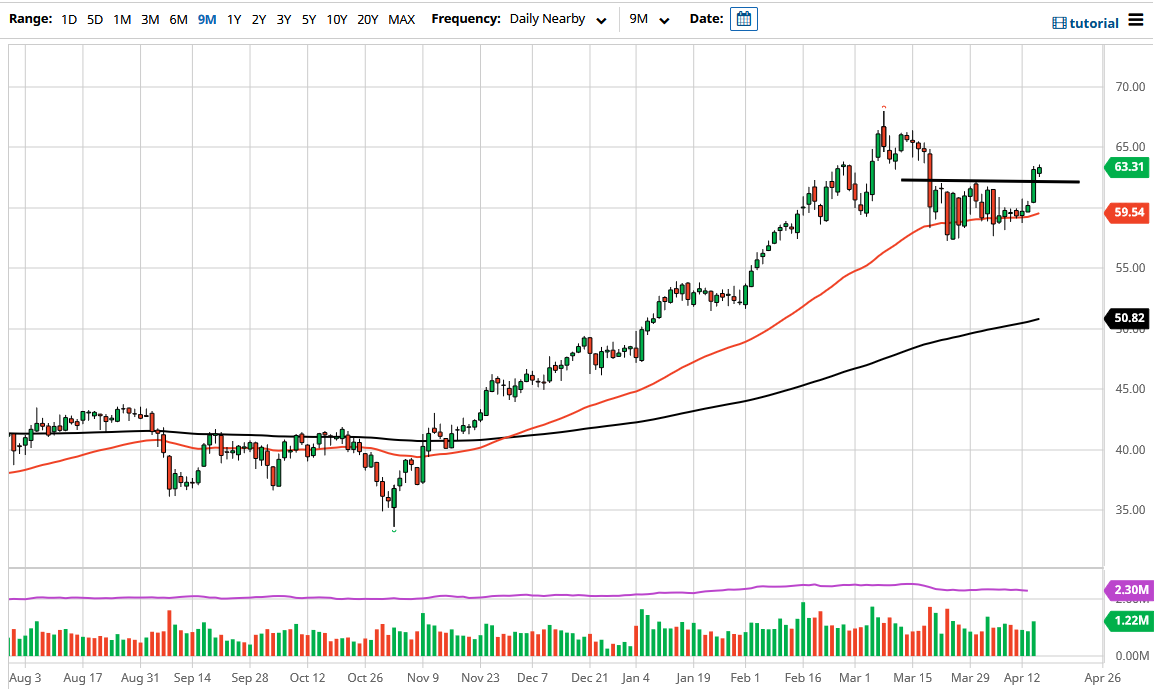

The West Texas Intermediate Crude Oil market has rallied again during the trading session on Thursday to continue showing bullish pressure. We are currently testing the $63.50 level, and it certainly looks as if we are trying to get towards the crucial $65 level. At this point in time, the $65 level is an area that we should be paying close attention to, because we have seen a lot of selling pressure previously, and of course it is a large, round, psychologically significant figure. It makes a nice target based upon the action that we have seen over the last couple of days it makes quite a bit of sense that we go looking towards there.

Underneath, the $62.50 level could offer support, as it was previous resistance. If we were to break down below there, then the market is likely to go looking towards the $60 level, which of course has the 50 day EMA sitting just below it. Because of this, there should be quite a bit of interest in that area, especially as it was the bottom of the overall consolidation area that kicked off into this area as of late.

Over the last couple of days, both the IEA and OPEC both have revised their outlook for demand upward, which of course suggests that there should be more strain on supply. In turn, that should be upward pressure on price as well. Ultimately, this is a market that I think will continue to see more upward than downward momentum, and as a result I think what we are looking at here is an attempt to continue the overall uptrend.

All of that being said, if we were to break down below the $57.50 level, that would be an extraordinarily negative sign, as it would not only be a significant drop, but the market will have sliced through the previous consolidation. That is typically a very negative sign, and it suggests that the market would go much lower. With this in mind, we could go looking towards the $52.50 level. That is an area that by the time we get there would probably feature the 200 day EMA as well. That makes a nice target, but quite frankly it does not look like we are going to see that happening anytime soon.