The West Texas Intermediate Crude Oil market was all over the place again during the trading session on Wednesday. The late Tuesday figures coming out of the American Petroleum Institute showed that crude oil inventories dropped in America, but at the same time we have seen gasoline and distillates rise. In other words, even though oil stocks have fallen, the reality is that the end user isn't using them yet.

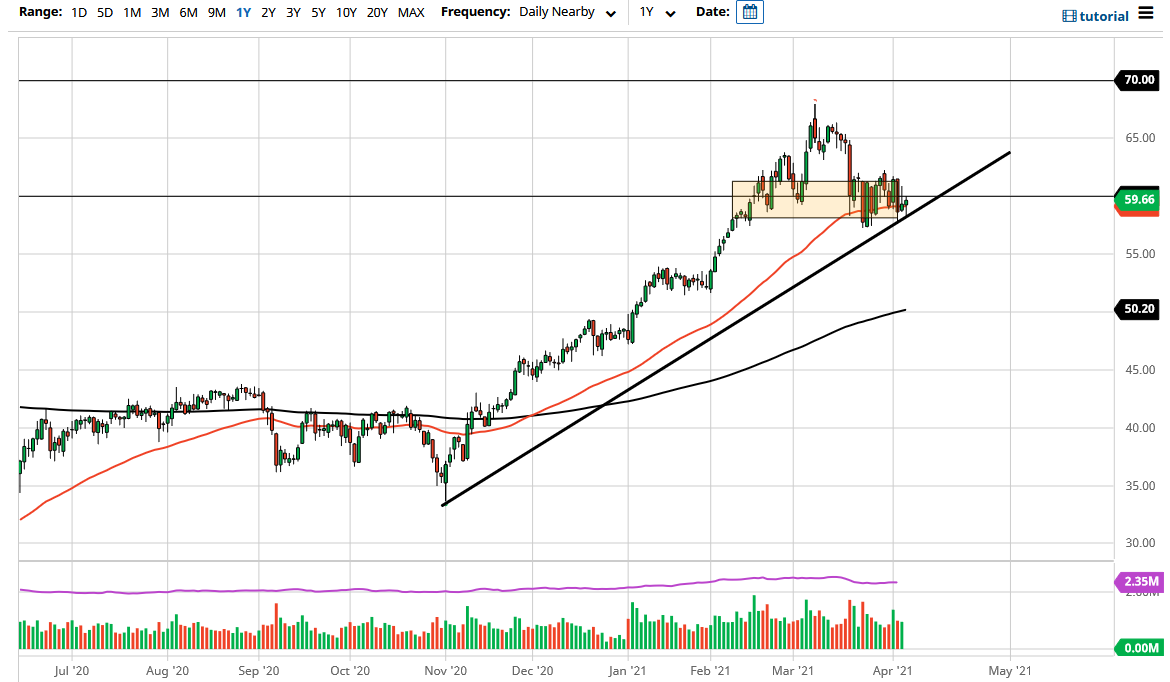

Wall Street has a great habit of being able to simply look beyond the obvious, so I will be surprised at all if they do try to push this market higher. That being said, we are sitting right on the trendline and that should focus a lot of attention on this market. The fact that we ended up forming a bit of a hammer is a bullish sign, especially as the candlestick before was a shooting star. The $60 level seems to be the magnet for price right now, so at this point I think we are going to have a move sooner or later, and when we do I plan on following it. If we were to turn around and break above the $62 level, then we are going to go looking towards the $65 level. On the other hand, if we break down below the $57.50 level, then I think we go looking towards the $54 level rather quickly.

Crude oil is very volatile under the best circumstances, but it is worth noting that OPEC has stated that they are going to increase production gradually over the next several months, so the question now is not so much as to whether or not there will be more oil, but whether or not there will be more demand going forward. The current environment is betting on a massive reopening trade driving oil use through the roof, but it is worth noting that recently we have seen more consolidation than anything else. Eventually we will break out of this region, and once we do then I am willing to put some money to work. Until then, it is only short-term back-and-forth trades that are going to be available, perhaps on something like a 15-minute chart. I think what we are looking at is a choppy and noisy market just waiting to happen.