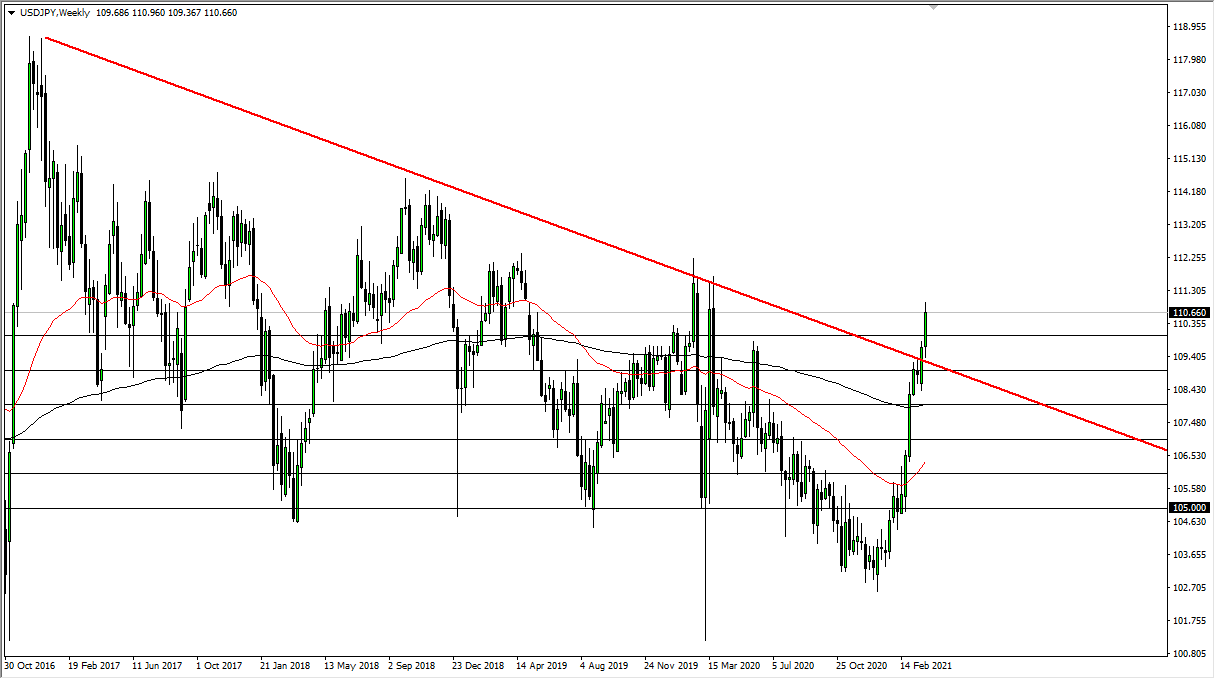

EUR/USD

The euro fell during most of the week to continue the overall downtrend that we have seen over the last several months. That being said, it certainly looks as if the euro is trying to catch itself. I think we probably still have a little bit of negativity to go, but we are getting pretty close to a major support level, especially as we get closer to the 1.16 handle. I do think that we will eventually test that level, but it certainly seems as if the speed of selling is going to slow down here in the next few weeks.

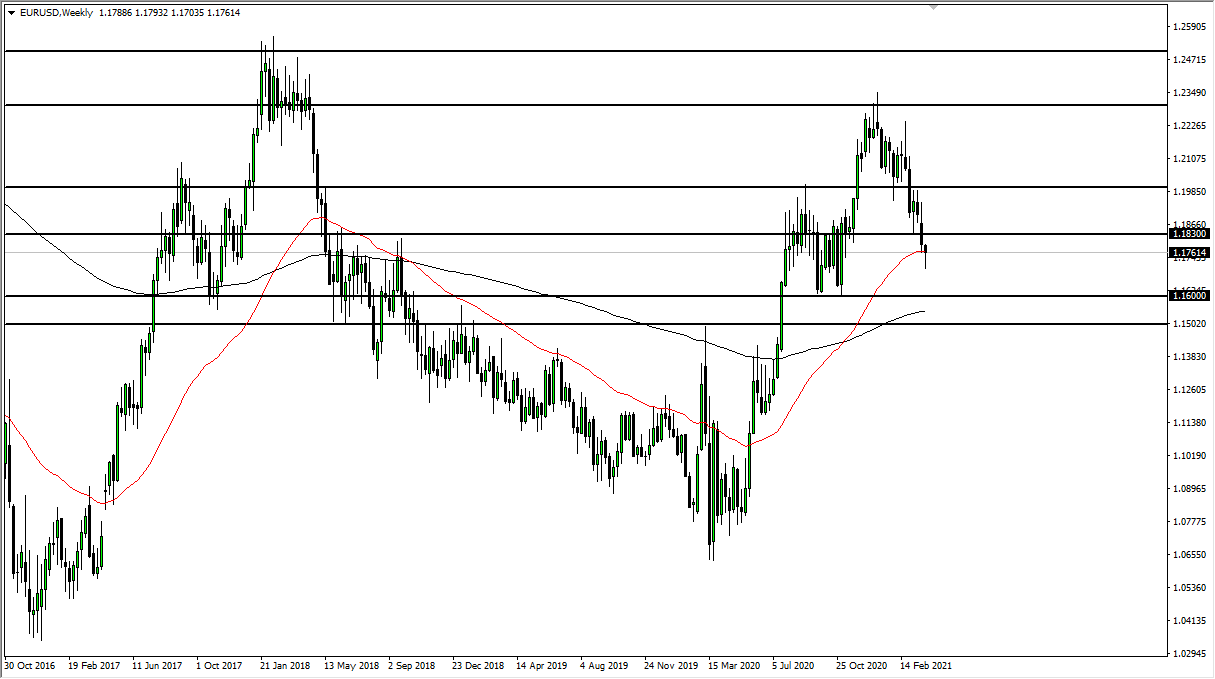

AUD/USD

The Australian dollar has broken down quite a bit during the course of the week, but also did recover a bit towards the end of it. That being said, this is going to come down to the yield in the bond market, specifically the 10-year note. If that continues to spike, then we will more than likely drop towards the 0.73 level. For what it is worth, you should keep in mind that the February and March candlesticks both are shooting stars, so I think we will continue to fade short-term rallies, at least for the time being.

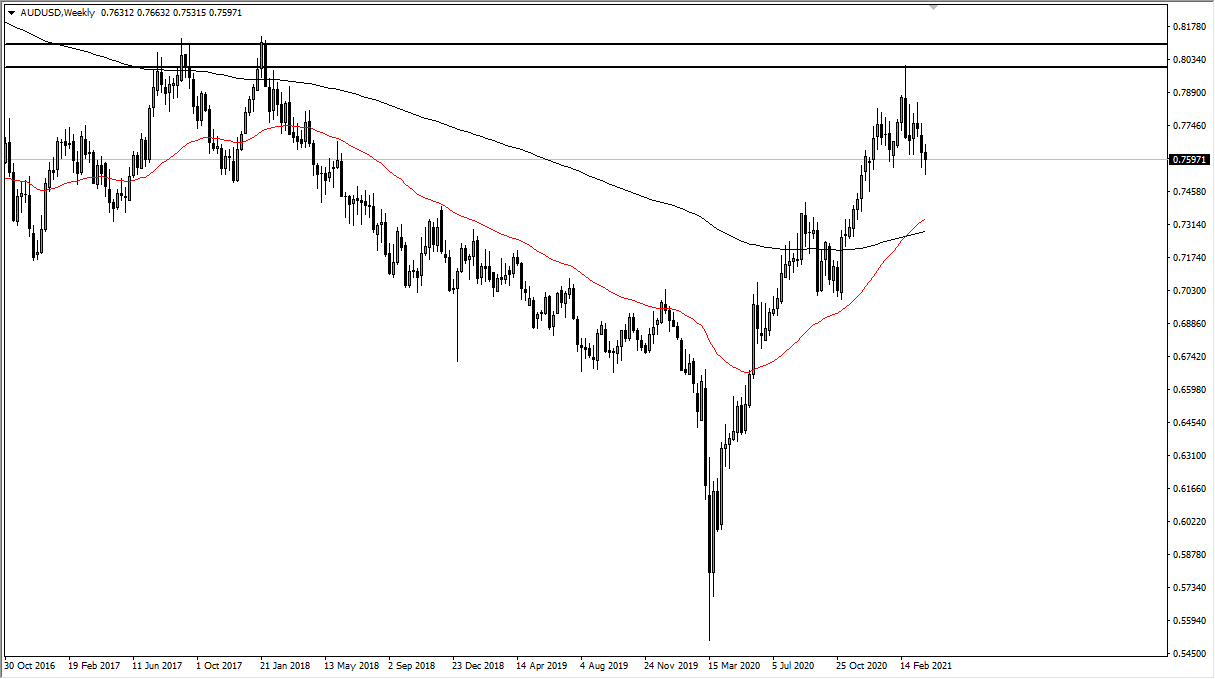

USD/CAD

The US dollar initially tried to rally during the course of the week, but then gave back the gains to end up with a neutral candlestick. At this point, we are starting to look at a potential bounce, but it seems to have been stifled during the week. I think we are going to continue to see a lot of choppy behavior in this general vicinity, because we are starting to approach rather significant support levels from the past. The 1.27 level above being broken to the upside would be a very bullish sign, which could kick off a complete turnaround for the next several months. In the short term though, I think we are simply looking at this market as one that will probably be sideways with a slightly downward tilt.

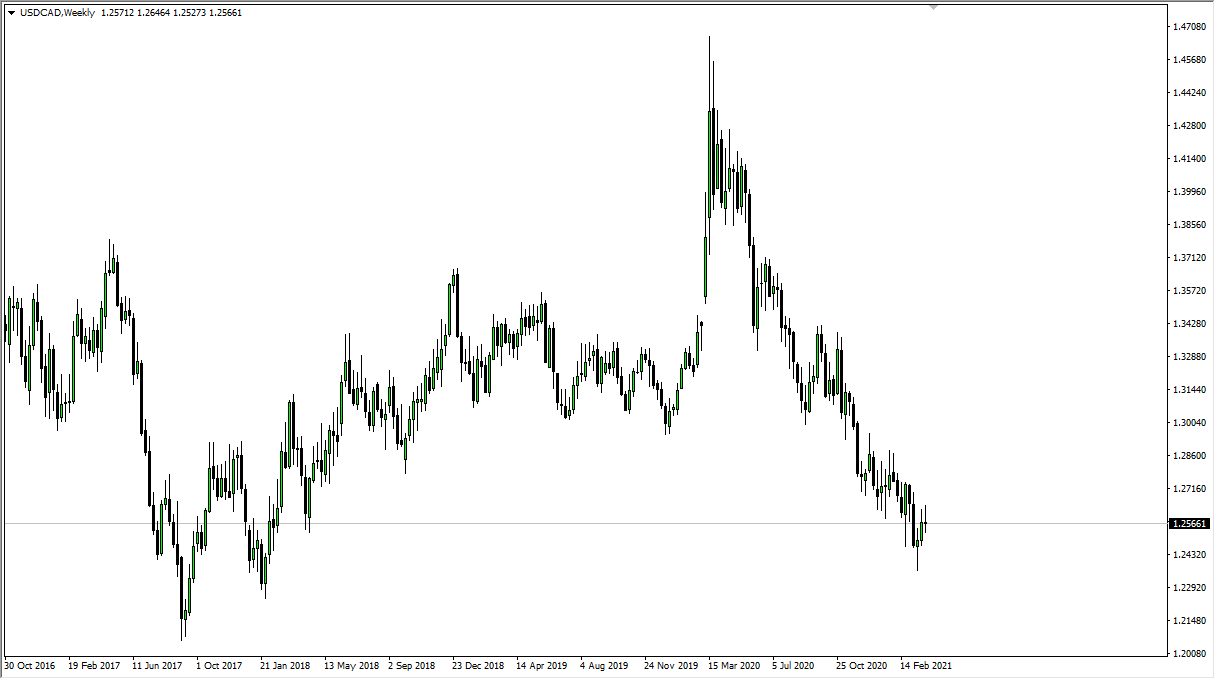

USD/JPY

The US dollar continues to climb against the Japanese yen, but I think this week might be the beginning of a short-term pullback. I would phrase this as “short-term pullback” because I believe that somewhere near the ¥109 level, we will see buyers jumping back in to continue the move to the upside. It is not until we break down below the ¥108 level that I would be concerned about the uptrend but at the very least I would say it is overextended. I would not be a buyer all the way up here.