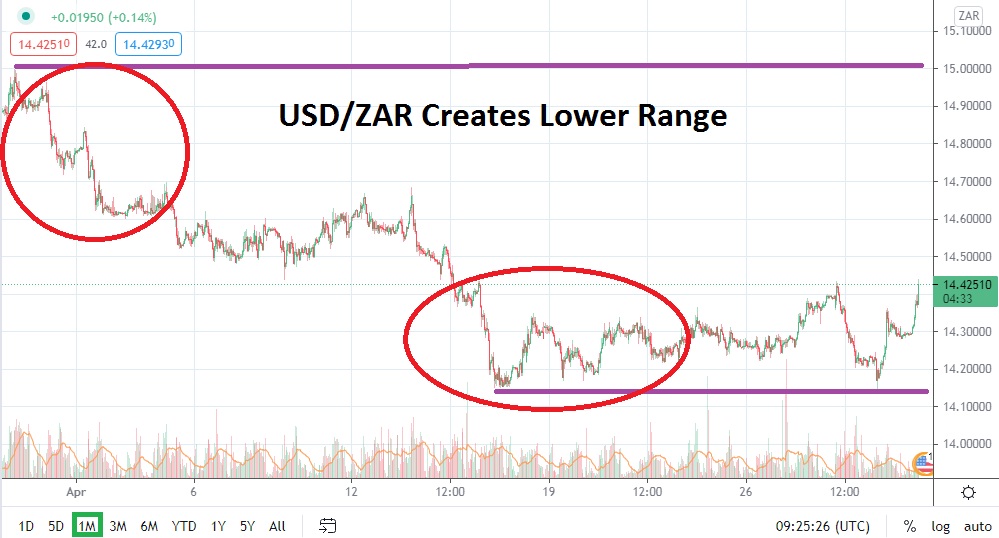

Speculators of the USD/ZAR have an important decision to make during the month of May. The forex pair was able to produce more bearish momentum the first two weeks of April and a solid low of nearly 14.12000 was seen on the 15th of the month. However, since hitting this low water mark, the USD/ZAR has seen its range become rather consolidated and traders have had to battle reversals on a rather regular basis.

The USD/ZAR has been able to demonstrate a solid long term bearish trend and its higher values tested early in the second week of March seem like a distant memory. Trading below the 14.70000 price has been a regular feature of the USD/ZAR since the end of the first week in April. The recent consolidation within the forex pair if it is maintained may be a signal additional downside momentum will be found, but as of this writing crucial resistance levels are rather close.

The range of 14.23000 to 14.44000 appears to be important technically. Traders who want to continue to pursue bearish momentum for the moment may want to remain cautious and simply use existing resistance levels as a place to launch their selling positions. The recent trading of the USD/ZAR will allow for rather comfortable stop losses. Traders who believe there are upside reversals which can be taken advantage of should probably not be too greedy and look for quick hitting trades.

Yes, the USD/ZAR has delivered higher reversals from its current prices levels in the recent past, but if resistance levels can be sustained near the 14.44000 mark this will be a signal for bearish traders to anticipate further moves downward. The USD/ZAR enters the month of May near extremely important values and a test of its short term consolidated range will likely emerge soon.

From a risk reward perspective the USD/ZAR is traversing within the lower boundaries of its long term charts. However, if current support levels begin to look vulnerable there could be potentially more room to traverse downwards compared to upwards within the USD/ZAR. Speculators who have favored bearish sentiment cannot be faulted for believing momentum is still on their side technically and lower values can be attained in May.

South African Rand Outlook for May:

Speculative price range for USD/ZAR is 13.54000 to 15.17000.

Bearish momentum within the USD/ZAR has continued to incrementally be delivered. On the 15th of April the USD/ZAR was trading near a low of 14.14000 which it last traded in late December of 2020. Consolidation has been seen in the USD/ZAR the past couple of weeks, but support levels are certainly within sight and if sustained trading breaks below the 14.30000 to 14.20000 levels, momentum could see an additional dose of selling which may challenge mid-April marks.

If the 14.14000 level is punctured lower it could set off a storm of price action which targets the 14.00000 juncture. If bearish momentum is able to show muscle below the 14.00000 ratio, traders may believe legitimate focus can be placed on values not seen since July of 2019 technically.

Important resistance is clearly within sight at the 14.50000 mark. This level has not been really tested since late in the second week of April. If resistance is penetrated speculators may believe a push higher towards the 14.67000 to 14.70000 ratios is plausible. If this higher resistance proves vulnerable another push towards the 15.00000 juncture could develop. The last time the 15.00000 price was tested was the 30th of March.