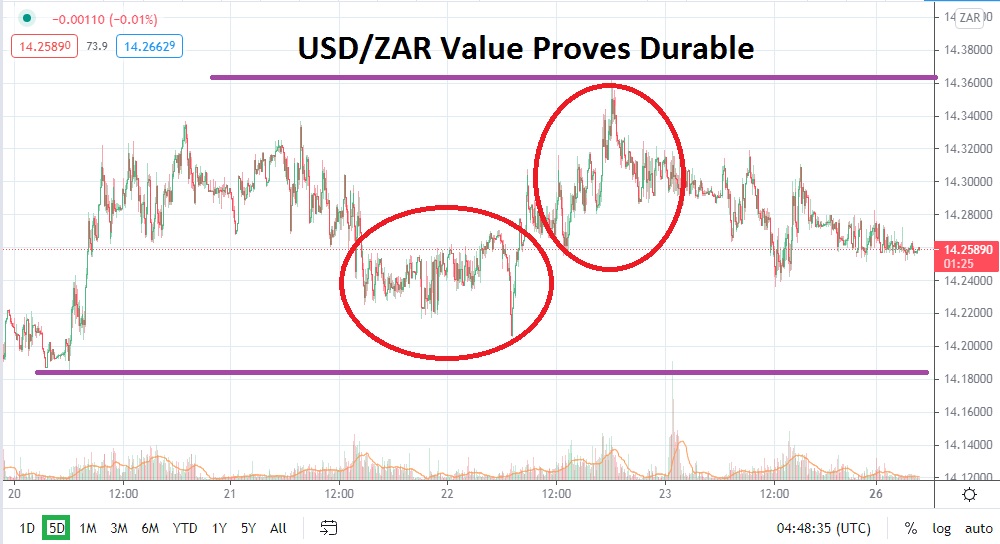

Technically, the USD/ZAR remains within the lower depths of its long-term range. However, the Forex pair has not been able to bust through existing support levels, and this has created a rather durable value range momentarily. Traders who have the ability to scalp the market with quick-hitting trades may find the current price ratios a solid opportunity to practice the art of limit orders.

Resistance around the 14.31000 mark appears to be rather solid, and support near the 14.22000 juncture has proven to create some bounce upwards. Certainly, the USD/ZAR has the capability to break this rather tight price range and accomplish this with volatility, but for the time being, the value band has created a rather attractive speculative landscape the past week.

In early trading this morning, the USD/ZAR is languishing near the lower rungs of its value as it hovers near the 14.260000 vicinity. Speculators who believe that the 14.23000 to 14.21000 junctures will prove strong may want to consider buying the USD/ZAR, aiming for slight reversals higher if the Forex pair approaches these lower marks by igniting ‘long’ limit orders.

Speculators who believe the downside momentum of the USD/ZAR long term has proven the trend still has room to traverse lower cannot be faulted, and in fact have a strong technical argument. However, traders who believe that more bearish sentiment is certain to be generated may need to be patient. Aggressive sellers can short the USD/ZAR on slight reversals higher from its current price ratio and target values below. Traders are urged not to be overly greedy within the current market, because the 14.21000 to 14.18000 ratios have caused plenty of reversals; early last week highlighted these tendencies.

For the moment, fast trades may prove to be the best profitable medicine for speculators. Taking advantage of the tight price range within the USD/ZAR should be considered. Perhaps the USD/ZAR has another bearish spurt which will rapidly be demonstrated, but in the short term, the use of take-profit orders and not allowing winnings to vanish may prove to be a solid decision. Cautious speculators may find the USD/ZAR is enticing because of it rather limited value range. Yes, volatility can certainly happen, but targeted support and resistance levels for the moment are alluring.

South African Rand Short-Term Outlook:

Current Resistance: 14.31000

Current Support: 14.22000

High Target: 14.35000

Low Target: 14.18000