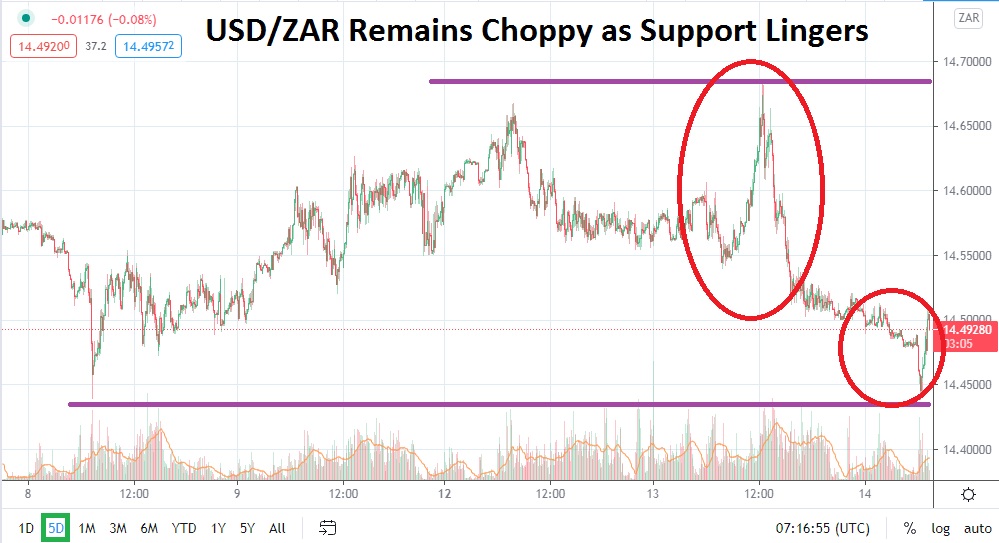

The USD/ZAR has demonstrated choppy results the past week. While a high of 14.68000 approximately was touched yesterday, a vibrant move downwards was quickly displayed by the USD/ZAR. As of this writing, the Forex pair is trading near the 14.50000 level as this juncture continues to demonstrate a psychological inflection point short term for the South African rand.

Current support levels remain long-term durable junctures, which can be seen while looking at technical charts. The past five days of trading have not been able to produce a solid test below existing support. This may lead speculators to continue to buy the USD/ZAR when support levels are approached and simply put close take-profit targets into action via carefully selected positions. Until the USD/ZAR is able to establish a stronger direction, traders may have to get used to its consolidated range.

Intriguingly for short-term traders, there may be the notion that the USD/ZAR has the capacity to extend its consolidated range and offer opportunities to aim for quick-hitting results. Global risk appetite remains rather optimistic and the USD has certainly shown a tendency to trade weaker against many major currencies in the past week. However, the USD/ZAR has absolutely found itself held within a tight value band as long-term support levels prove quite adequate.

Until the 14.45000 to 14.40000 junctures below look like they are vulnerable, traders should not become too greedy if they are selling the USD/ZAR. The USD/ZAR may have further room to traverse downward, but before it accomplishes this momentum, speculators may find that the best option to wager on the Forex pair is to actually look for reversals which have been occurring consistently within its existing short-term range.

Buying the USD/ZAR below the 14.50000 juncture looks to be a rather comfortable speculative wager. Stop-losses can be used with tight ratios and take-profits should target nearby values for slight upside momentum cycles. The USD/ZAR may remain within a tight band short term. Risk/reward considerations may contemplate that further downside action will develop and potentially break existing support junctures, but until this happens, traders should accept the consolidation and take advantage of it with fast trading positions.

South African Rand Short-Term Outlook:

Current Resistance: 14.64000

Current Support: 14.47000

High Target: 14.71000

Low Target: 14.39000