In flagrant disregard for positive US economic data, the USD/JPY sold off, which pushed the pair towards the 107.47 support level, a near 2-month low. The pair settled around 107.85 at the beginning of this week's trading.

US jobless claims continued to decline sharply, and in the past week 547,000 claims were reported, which is the lowest reading of claims since the outbreak of the epidemic, which is an encouraging sign that layoffs are slowing due to the strength of the improving US labor market. Meanwhile, the US Labor Department said orders were down 39,000 from the revised 586,000 the previous week. Weekly jobless claims have fallen sharply from a peak of 900,000 in early January. At the same time, they are still well above the level that prevailed before the virus spread in March last year, which amounted to about 230,000 people. Accordingly, analysts believe that with 135 million Americans receiving at least one dose of the COVID-19 vaccine, and the economy becoming more open every day, the number of jobs will continue to rise.

The general US labor market is making steady gains. Last month, the country's employers added 916,000 jobs, the largest number since last August, in a sign that a sustainable recovery is taking hold. The US unemployment rate has fallen from 6.2% to 6%, which is well below the epidemic peak of nearly 15%.

Shops, bars and theaters in Japan closed their doors on Sunday as part of emergency measures to slow the wave of COVID-19 infections. The 17-day restrictions were announced for Tokyo, Kyoto, Hyogo and Osaka, ahead of the "Golden Week" holiday, when the Japanese usually travel heavily. The effectiveness of this effort, which focuses on restaurants and parks that remain closed or limit hours, is doubtful. Trains and streets remain as crowded as ever, and schools will remain open.

Japan has already declared three coronavirus emergencies. The vaccine rollout has been slow, with only 1% of its population vaccinated. One of the setbacks is that Japan requires additional testing of vaccines approved abroad, and only the Pfizer vaccine is in use now. Experts say the unfolding wave of infections includes more lethal variants. Japan has attributed nearly 10,000 deaths to COVID-19, which is among the worst in Asia. A local vaccine is not expected to be produced until next year or 2023.

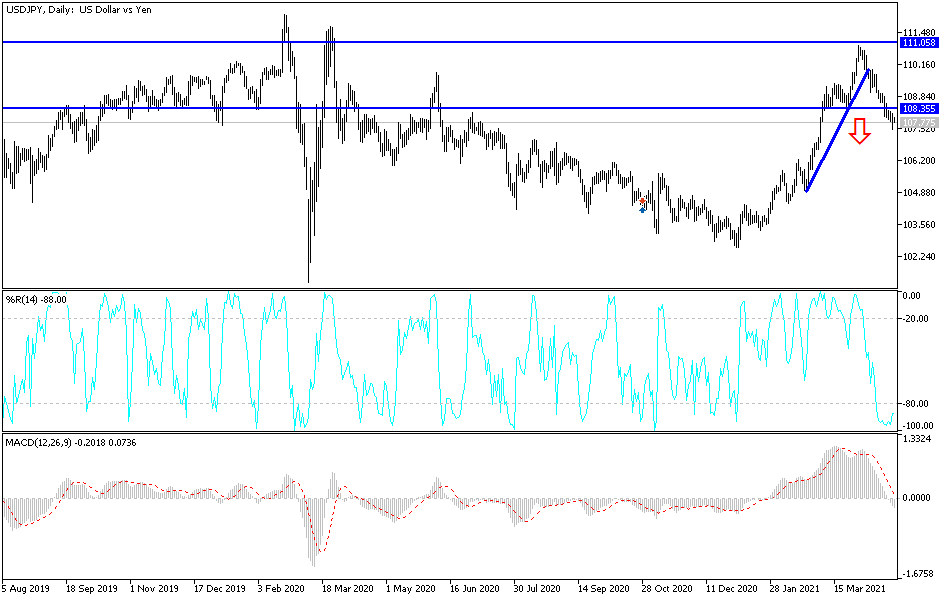

Technical analysis of the pair:

The general trend of the USD/JPY is still bearish, and a breach of the 108.00 support increases the bears' control over the performance and at the same time pushes some technical indicators to oversold levels. I still prefer to buy the currency pair from every downward level. The strongest buying levels are currently 107.55, 106.80 and 105.90. On the upside, no significant reversal of the current trend will take place without breaking through the psychological resistance 110.00 again.

The currency pair will be affected by investor risk appetite, as well as the announcement of US durable goods orders.