After gains on the cusp of the 111.00 resistance, a one-year high, profit-taking pushed the USD/JPY to the support level of 109.57 before settling around 109.75 as of this writing. So far, the US dollar is still in a good position as the ongoing economic stimulus plans and the US government's efforts to accelerate the pace of vaccination to restore activity to the largest economy in the world will place the United States at the forefront of global economies recovering from the effects of the devastating pandemic.

Despite recent indications of the strength of the US economy, the minutes from the latest monetary policy meeting of the Federal Reserve Board indicated that the central bank is unlikely to change its very loose monetary policy anytime soon. Participants at the March meeting acknowledged an improvement in the medium-term outlook for real GDP growth and employment, but continued to see the uncertainty surrounding these expectations elevated.

The minutes also showed that most of the participants still saw the coronavirus pandemic as a significant risk to the economic outlook. Among the risks that participants cited were new, more contagious virus strains, barriers to getting sufficient numbers of the public to be vaccinated, or overburdened social distancing. “However, given the economy’s resilience in the face of an early rise in new COVID-19 cases, hospitalizations, deaths and the scale of financial support enacted, the downside risks to the economic outlook were seen as lower than before,” read the transcript of the bank’s meeting.

The Fed added: "Staff saw that the risks of upward inflationary pressures have increased since previous expectations, and now they see risks to inflation expectations balanced." With the economy continuing its actions below pre-epidemic levels, the Fed reiterated that it is likely that "some time" will pass before the central bank considers changing its monetary policy stance.

The minutes added that members expect to maintain a favorable monetary policy stance until the Fed's targets of maximum employment and inflation of moderately above 2% are met for some time. The Fed's opinions were largely unchanged from previous months, with the minutes noting that results-based guidance did not need to be recalibrated often in response to incoming data or evolving expectations.

"In particular, many participants noted that changes in the course of policy should be based primarily on monitored results rather than expectations," the US central bank added. The minutes also highlighted the recent increase in long-term Treasury yields, which is largely due to increased investor optimism about the economic outlook and expectations of higher Treasury bond issuances.

The Fed noted that market depth became weak and supply and demand margins widened amid a particularly sharp increase in yields on February 25, but said that Treasury liquidity gradually recovered over the following days. The updated economic projections submitted after the meeting showed that council members now expect the GDP of the United States to increase by 6.5% in 2021 compared to expectations of 4.2% last December.

The forecast for the pace of growth in core consumer prices, which excludes food and energy prices, was revised upwards to 2.2% from 1.%. In its accompanying statement, the Federal Reserve acknowledged the recent emergence of economic activity and employment indicators. However, the median forecast from Fed members expects US interest rates to remain at current levels through 2023.

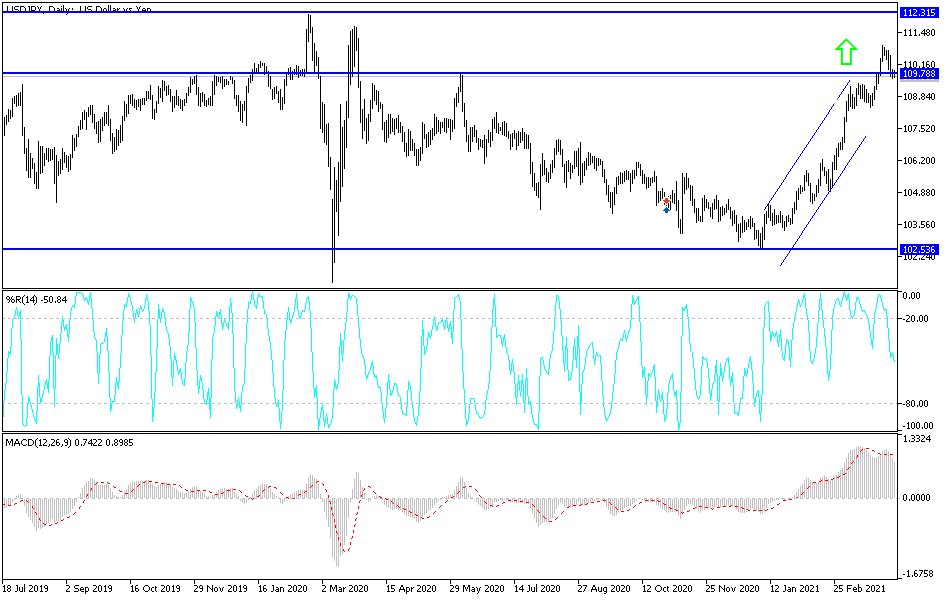

Technical analysis of the pair:

The return of stability in the USD/JPY above the psychological resistance of 110.00, will strengthen the bulls' control over the performance. Consequently, there will be more buyers to complete the upward path, which is still in place despite the recent correction. The general outlook for the pair will not turn bearish without settling below the support level of 108.80. I still prefer to buy the currency pair from every downside.

In addition to the extent of investor risk appetite, the currency pair will be affected by the announcement of the number of US weekly jobless claims and statements by Federal Reserve Chairman Jerome Powell.