The psychological resistance 110.00 is still lacking the necessary momentum to return to the path of its ascending channel. This morning, it recovered to 109.76 before settling around 109.50 at the time of writing, and awaits the announcement of the US inflation numbers.

The negative results of the trade balance figures in China this morning contributed to the safe haven gains of the Japanese yen. On the other hand, the US dollar was negatively affected after the announcement yesterday that the US government budget deficit rose to its highest level ever at 1.7 trillion dollars due to the continuous passage of massive and standard stimulus plans to support the US economy in the face of the effects of the pandemic.

On the Coronavirus front, more than 120.8 million people, or 36.4% of the US population, have received at least one dose of the Coronavirus vaccine, according to the Centers for Disease Control and Prevention. About 74 million people, or 22% of the population, have completed their vaccinations. In terms of cases, the seven-day rolling average of daily new cases in the United States over the past two weeks rose from 63,236 on March 28 to 70,040 on Sunday, according to Johns Hopkins University.

As for the deaths, the seven-day rolling rate of new daily deaths in the United States over the past two weeks has not increased from 975 on March 28 to 969 on Sunday, according to Johns Hopkins University.

At the global level, the United Nations Secretary-General said that the world's failure to unite to tackle COVID-19 has led to wide disparities, and called for urgent action, including a wealth tax, to help fund the global recovery from the Coronavirus. Accordingly, the Secretary-General of the United Nations, Antonio Guterres, said at a high-level meeting of the United Nations yesterday that the latest reports indicate "an increase of 5 trillion dollars in the wealth of the richest people in the world last year" from the epidemic. He urged governments to "consider imposing a solidarity or wealth tax on those who have benefited during the pandemic, to reduce severe inequalities.

Guterres also told the United Nations Economic and Social Council Forum on Financing for Development that "no component of our multilateral response has gone as far as it should." He pointed to more than 3 million deaths, an increase in injuries, the worst economic recession in 90 years, about 120 million people falling into extreme poverty, and the equivalent of the evaporation of 255 million full-time jobs. Guterres added that inequality in vaccines is only one example of the failure of diversity.

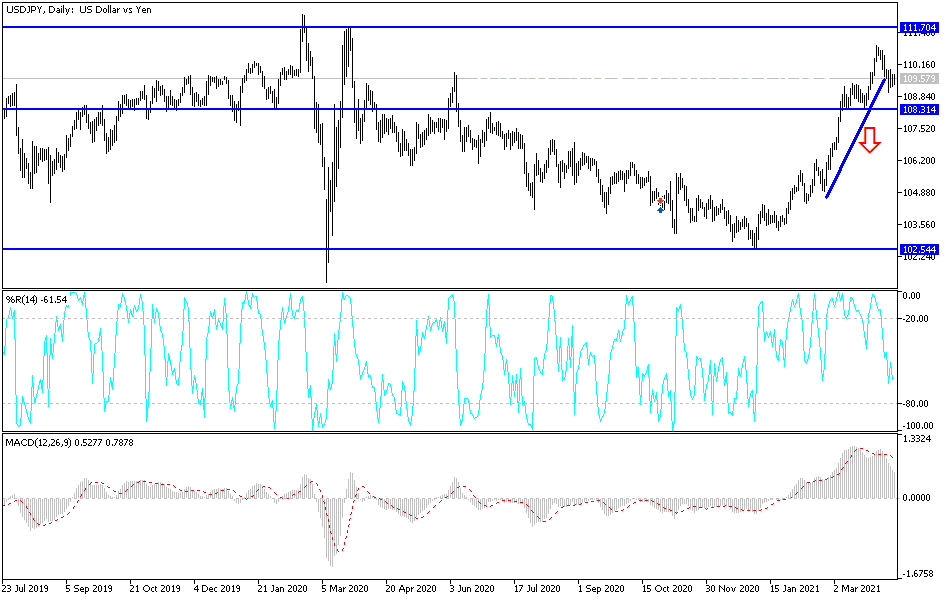

According to the technical analysis of the pair: The success of the bulls in pushing the US dollar against the yen to stabilize above the psychological resistance of 110.00. It will be important to return to the path of its clearer ascending channel on the daily timeframe chart. On the other hand, the breach of the support level 108.80 will support the bears' control over the performance and warn of a stronger bearish move, as the technical indicators support the strength of the downside momentum.

Today, the currency pair will interact with investor sentiment regarding risk appetite or not, as well as a reaction from the announcement of the consumer price index reading to measure US inflation