The USD/JPY is trying to compensate for its recent sharp losses that pushed it towards the 107.47 support level, a near-2-month low, by stabilizing around 108.35 as of this writing. This move comes after the Japanese central bank announced its monetary policy decisions. On the other hand, Japan will tighten its border controls at airports after health authorities found 21 cases of a new Indian double mutant that experts say may be more contagious.

In this regard, the Chief Cabinet Secretary, Katsunobu Kato, said yesterday that all 21 different cases have been discovered except for one case in arrivals to Japanese airports. The substitute contains two mutations in the spiky protein that the virus uses to attach itself to cells. India is seeing the worst increase in virus cases in the world, in part due to this mutant. Therefore, experts fear that it could exacerbate the ongoing boom in Japan, fueled by another variable discovered earlier in Britain.

Japan began emergency measures on Sunday in Tokyo, Osaka and two neighboring prefectures, closing bars, karaoke, shops, theaters, museums and other non-essential businesses and requiring stay-at-home and other precautions for residents until May 11.

Japan's third state of emergency three months before the scheduled opening of the Olympics in July is raising questions about whether or not the country can stage events safely. In this regard, Kato said Japan will intensify its border controls, collecting and analyzing data on variables to prevent further spread of infection.

Japan recorded 562,141 cases, an increase of more than 5,400 from the previous day, and 9,913 deaths on Friday, according to the Ministry of Health.

In contrast, more than half of American adults received at least one dose of the vaccine.

Across the country, pharmacists and public health officials are seeing demand dwindle and supplies pile up. About half of Iowan counties have stopped ordering new doses from the state, and Louisiana has not requested shipment of some vaccine doses over the past week. This confirms the extent of the US progress in obtaining more vaccines and providing vaccination to more American people, which paves the way for the restoration of economic activity and thus providing the necessary support for the strength of the US dollar.

Forex and other global financial market traders are looking forward to the Fed's monetary policy announcement on Wednesday. The dollar's weakness was due to expectations that Fed Chairman Jerome Powell would stick to the ultra-accommodative monetary policy stance.

Yesterday, a report issued by the Commerce Department showed that new orders for durable goods manufactured in the United States increased by much less than expected in March. The ministry said durable goods orders rose 0.5% in March after falling -0.9% in February. Economists had expected durable goods orders to rise 2.5%, compared to the-1.2% decline reported in the previous month.

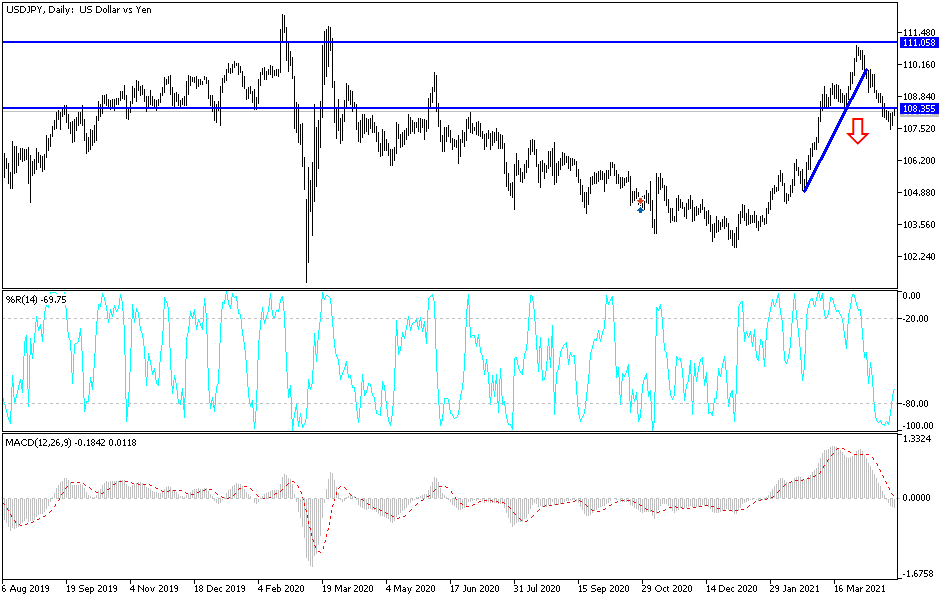

Technical analysis of the pair:

Even with attempts to rebound, the USD/JPY is still in the range of a sharp descending channel, as shown on the daily chart below. There will be no strong change in the direction to the upside without breaching the psychological resistance of 110.00. Stability below the support 108.00 increases the bears' control and thus a move towards stronger support levels, the closest of which are 107.75, 107.10 and 106.55. I still prefer to buy the currency pair from every downside. The currency pair may remain in a narrow and limited range until the US Federal Reserve announces its monetary policy decisions tomorrow.

Today, the currency pair will be affected by market risk appetite, as well as the announcement of the US Consumer Confidence Index reading.