For two weeks in a row, the USD/JPY has been moving in a distinct upward correction range that has launched it near the 111.00 resistance level, a one-year high. This is in the midst of a strong recovery of the US dollar in the Forex market, supported by a strong improvement in the results of economic data, especially the US labor market. This also supported the Fed's assertion that although it does not intend to raise the US interest rate until at least 2023, it is satisfied with US bond yields, which have doubled in some periods this year, which has led to tightening financing conditions for companies and households.

On the economic side, US jobs data came in better than expected, as 916,000 jobs were created in March compared to an expectation of 647,000 jobs. The unemployment rate matched the expected rate of 6%, down from the 6.2% reported in February. However, average wage growth failed to match the projected (year-on-year) rate of 4.5% with a growth rate of 4.2%. Even with the big increase last month, the US economy is still missing more than 8 million jobs from the number it was before the outbreak of the epidemic just over a year ago. But with the recovery broadly expected to be strong, many economists expect enough employment in the coming months to recoup nearly all of the lost jobs by the end of the year.

However, restoring all of these jobs will be a daunting task.

US bond yields have reached record levels, indicating that financial markets are optimistic about a strong recovery that may result in higher prices for some goods and services. Accordingly, the yield on the 10-year US Treasury bonds increased from 1.68% to 1.71%. Stock markets are closed on Good Friday. The bright outlook for the US labor market comes on the heels of a year of epic job losses, waves of coronavirus contagion and small business closures. Several indications say that the economy is improving. Consumer confidence in March reached its highest level since the outbreak of the pandemic.

A survey found that US manufacturing grew in March at the fastest pace since 1983. Vaccines are increasingly being administered, although new confirmed infections have risen from low levels in recent weeks.

Speaking after the government released the jobs report, US President Joe Biden said he showed that the $1.9 trillion financial rescue package - which included $1,400 checks for most adults - was actually boosting the economy. However, Biden argued that more help in the form of an infrastructure package his administration unveiled last week was necessary to preserve the gains.

"The battle is not over yet," Biden said in televised remarks. The progress we have worked so hard to achieve can be reversed.” Yet many Republican lawmakers have already pointed to the booming economy as evidence that more government support is not needed.

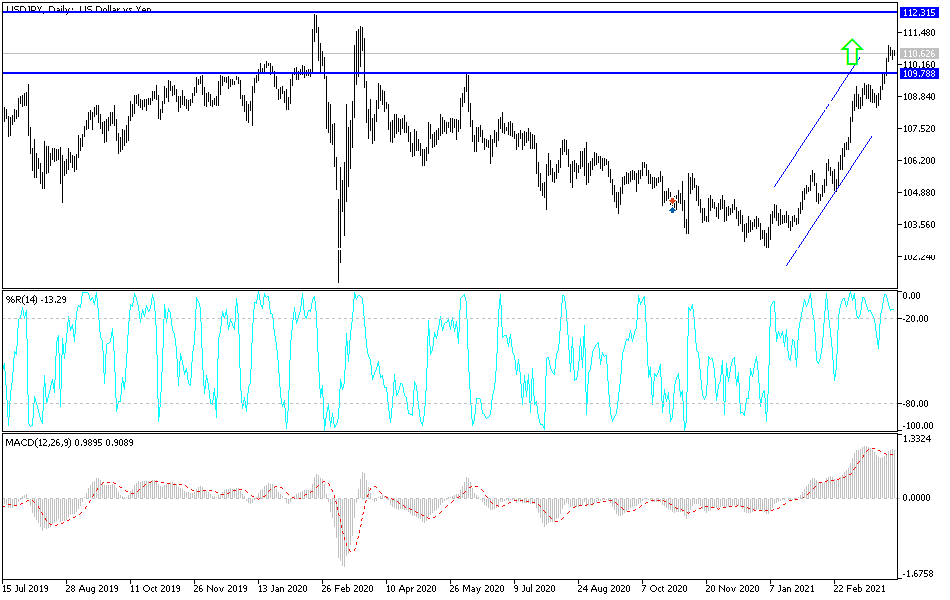

Technical analysis of the pair:

In the near term, and according to the performance on the hourly chart, it appears that the USD/JPY is trading within the formation of a descending channel, which indicates a slight short-term bearish momentum in market sentiment. Therefore, the bears will look to extend the current decline towards the 110.42 support or lower to the 110.21 support. On the other hand, the bulls will be targeting short-term bounces around 110.84 or higher at the 111.03 resistance.

In the long term, and according to the performance on the daily chart, it appears that the USD/JPY pair has recently made an upside breakout from forming a descending channel, which indicates a sudden change in market sentiment from bearish to bullish. Accordingly, the bulls will look to ride the current bullish wave by targeting profits around the 112.05 resistance or higher at the 113.60 resistance. On the other hand, the bears will be looking to pounce on dips around 109.172 or below at 107.577.

There is no significant Japanese economic data today, and from the United States, the ISM Services PMI reading, followed by the number of US factory orders, will be announced.