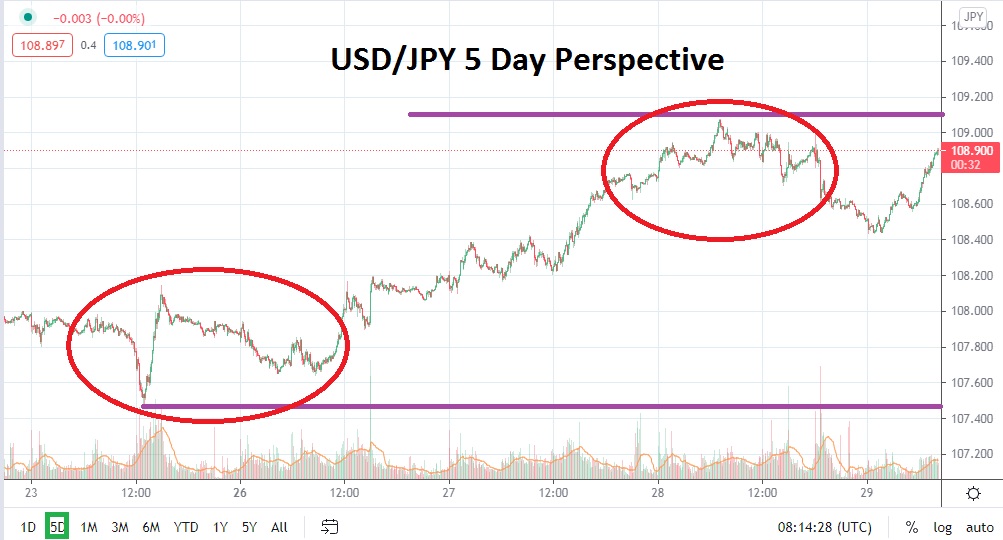

Since the first week of March up until now, the USD/JPY has traded largely within the 107.900 to 108.9500 range. However, from the end of March until the middle of April, the USD/JPY actually traded above the 109.000 mark for a two-week duration and reached a high of nearly 110.800 on the 30th of March. While the USD/JPY paints a rather middling range currently, it is trading near important resistance levels and, if they are proven vulnerable, the USD/JPY may be inclined to test the two-week duration in which it was able to trade above the 109.000 mark.

The USD/JPY has found a strong dose of support near the 108.000 ratio, and current support levels near the 108.550 to 108.440 junctures may continue to be targets by speculators who believe that selling the Forex pair remains a good tactical decision when resistance proves durable. The USD/JPY has produced a rather intriguing range the past month. After hitting highs in late March as mentioned above, the USD/JPY traded at a low of nearly 107.500 on the 23rd of April.

In the past week, the Bank of Japan and US Federal Reserve have made their monthly central bank statements and both have kept their dovish policies in place with no changes likely in the foreseeable future. The USD/JPY should be watched closely as it trades near the 109.000 juncture. If the Forex pair breaks above resistance, some speculators may believe that a retest of the values 109.200 to 109.900 from the 6th until the 13th of April might be demonstrated.

However, for the moment, the USD/JPY remains below the higher April values by a healthy distance, and yesterday’s test of resistance near 109.005 proved adequate enough to cause a reversal lower and the 108.440 mark was touched. The current range of the USD/JPY may continue to be rather consolidated short term and traders may find their best opportunities are via existing resistance levels to sell.

If the 109.005 to 109.115 levels prove durable, more bearish trading may develop within the USD/JPY short term. If the 109.200 begins to look vulnerable, it is possible that another test of highs seen the second week of April could develop. Traders should be cautious within the USD/JPY for the time being and use limit orders effectively.

USD/JPY Short-Term Outlook:

Current Resistance: 109.007

Current Support: 108.550

High Target: 109.230

Low Target: 107.810