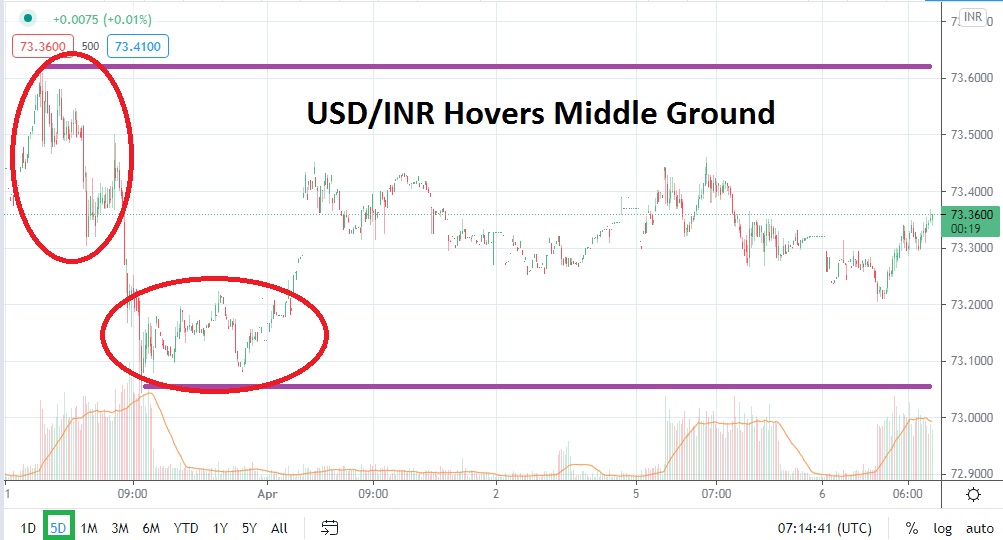

The USD/INR finds itself within the mean as the Sorex pair hovers within the middle ground of its one-week range. The USD/INR is still near one-month highs as it trades near 73.3400 early this morning. A high of 73.6000 was touched late last week and technical traders may look at the failure of the USD/INR to attain late February’s highs as proof that this speculative bullish cycle may be running out of power.

The USD/INR has been hit with plenty of volatility the past five weeks as investment houses have reacted to US stimulus policy and the outlook on US bond yields. However, skeptics who have been absorbing body blows as they have watched their bearish USD perceptions come under fire may be getting ready to step forward and wager on long-term trends being reignited.

As the USD/INR trades within the middle of its one-week range, the Forex pair has shown a tendency to incrementally lower resistance levels. Yes, holiday trading has been in effect the past week globally and volumes have been thin throughout Forex; today and tomorrow’s results should be watched carefully by technical traders in order to monitor short-term sentiment. Volatility could develop if large transactions create imbalances for the USD/INR.

The USD/INR was trading at approximately 72.3600 on the 26th of March. This number is provided to suggest that the buying of the USD/INR may have been overdone and too strong a reaction. The ability of the USD/INR to trade within a rather tranquil mode yesterday and actually demonstrate some downside momentum suggests there may be more room to cover. From a risk/reward perspective, speculators may believe from looking at technical charts that a greater chance exists to see larger bearish moves compared to bullish gyrations.

Selling the USD/INR may feel like it is going against a one-week trend, but there are signs technically that the Forex pair may be valued too highly. If a speculator wants to sell the USD/INR on slight moves higher which come within sight of short-term resistance levels, this decision cannot be faulted. Traders should not be overly greedy regarding their selling positions and use take-profits which do not let winning positions linger.

Indian Rupee Short-Term Outlook:

Current Resistance: 73.4100

Current Support: 73.2500

High Target: 73.4800

Low Target: 73.0700