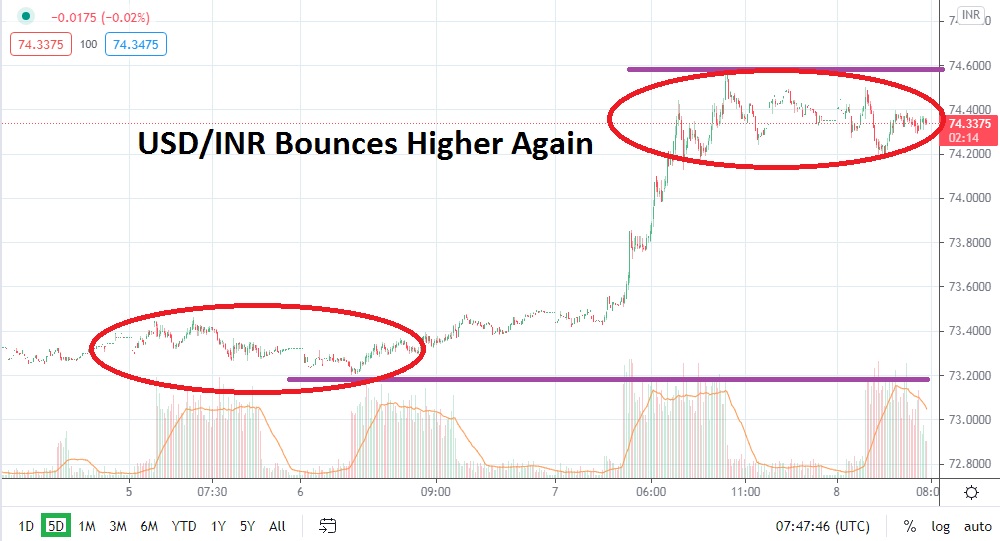

After moving within a comfortable range the past week, the USD/INR suddenly burst higher yesterday and essentially killed all short-term resistance levels. The loss of value within the Indian rupee was one of the biggest moves the currency has had against the USD in over a year-and-a-half, and has situated the USD/INR near important long-term resistance levels which now must be contemplated.

The USD/INR is now within sight of values not traversed since the middle of November 2020. When the USD/INR climbed to a high of nearly 74.9000 on the 4th of November, it accomplished this after the Forex pair had traded near 72.9700 on the 13th of October. Short-term traders should look closely at one-year technical charts of the USD/INR to gain perspective regarding potential volatility.

Only two days ago, the USD/INR looked as if it might be able to reestablish bearish momentum. The Forex pair has established choppy results the past three months and the ability of the USD/INR to come within sight of the 73.5000 juncture early this week provided a technical perspective that the Indian rupee may begin to challenge its lower price range which was demonstrated during the month of March.

However, yesterday’s price action will certainly make speculators nervous. As always, it is highly recommended that traders use risk management when wagering on the USD/INR. The capable volatility of the Forex pair was exhibited in a wild fashion yesterday, and if traders were caught unprepared they likely are sitting on the sidelines today wondering what to do next. From a technical perspective, the USD/INR looks to be overbought, but it will take courageous speculators to attempt challenging the momentum upwards demonstrated.

However, this is why trading Forex is called speculation. With the use of proper risk management and the correct amount of leverage a trader can survive days like this Wednesday and live to trade another time. Some days, being a trader is like being in a fight, and making sure you survive is the priority.

The USD/INR does look highly valued and current resistance levels which are using technical data not contemplated since the middle of November 2020 might make the Forex pair an attractive speculative selling position. Cautious traders may want to wait a day, conservative traders who do want to sell the USD/INR now may want to wait for upside ticks before launching selling positions at these heights.

Indian Rupee Short-Term Outlook:

Current Resistance: 74.6000

Current Support: 74.1400

High Target: 74.9300

Low Target: 73.7600