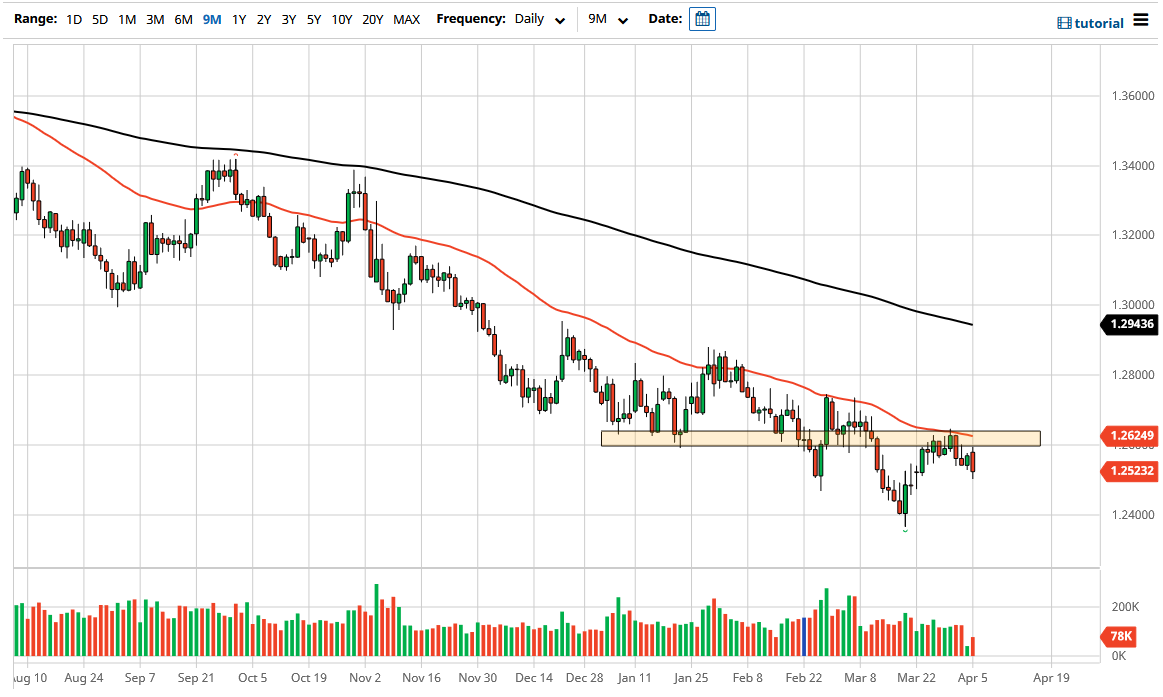

The US dollar initially tried to rally against the Canadian dollar during the trading session on Monday but then gave up any signs of strength to crash into the 1.25 level. It is interesting that we have held that area, because it has shown the big figure to be important, and it is even more curious considering that the dollar fell against the Canadian dollar, despite the fact that oil fell over 3% during the trading session.

The question at this point is whether or not we are at a crossroads? After all, if oil was going to start falling, especially as OPEC is going to begin producing more crude oil, and beyond that the Americans are going to be producing more shale. If that is going to be the case, then oil continues to fall, and it could in theory bring down the value of the Canadian dollar.

All things been equal though, once worth paying attention to is the fact that we are in a massive downtrend, and therefore we are still looking to sell this move on signs of exhaustion, even though we have seen the US dollar strengthened against many other currencies recently. Because of this, it is worth keeping in mind that this market has been a bit disconnected from some of the others, but if we were to turn around a break above the 50 day EMA on a daily close, then we could see the beginning of a turnaround. A turnaround in that sense could be a sign that we are going to go to the 1.27 level, possibly even the 1.28 level. It is certainly clear that the US dollar can strengthen as we have seen against other currencies, so if oil falls, that could be the last vestige of support for the Loonie.

On the other hand, if we were to turn around and break down below the lows at 1.24, that opens up a move for another 400 points to the downside based upon the monthly chart. As things stand right now, that is probably the best case scenario, but this pair does tend to be extraordinarily choppy so it should not be a huge surprise that we probably will not get a very clean move one way or the other. With that in mind, I would be cautious, but I think the easiest trade is that if crude oil turns around and goes higher, then it is much easier to simply short this pair.